Page 156 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 156

Financial Accounting-I

Notes Interest on Bank Loan 1,80,000

Stock on 1st April, 2007:

Raw Material 1,20,000

Work-in-Progress 90,000

Finished Goods 1,23,000

Sales 58,50,000

Return Outwards 25,500

Carriage Inwards 31,500

Discount allowed 3,000

Sale of Scrap 6,000

Depreciation on Plant 1,50,000

Depreciation on Furniture 12,000

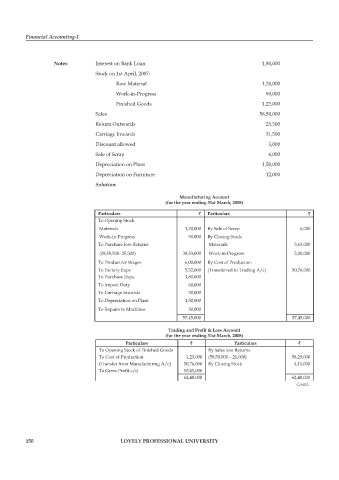

Solution:

Manufacturing Account

(for the year ending 31st March, 2008)

Particulars ` Particulars `

To Opening Stock

Materials 1,20,000 By Sale of Scrap 6,000

Work-in-Progress 90,000 By Closing Stock:

To Purchase less Returns Materials 3,63,000

(39,58,500- 25,500) 39,33,000 Work-in-Progress 3,00,000

To Productive Wages 6,00,000 By Cost of Production

To Factory Exps 5,52,000 (Transferred to Trading A/c) 50,76,000

To Purchase Exps. 1,80,000

To Import Duty 60,000

To Carriage Inwards 30,000

To Depreciation on Plant 1,50,000

To Repairs to Machines 30,000

57,45,000 57,45,000

Trading and Profit & Loss Account

(for the year ending 31st March, 2008)

Particulars ` Particulars `

To Opening Stock of Finished Goods By Sales less Returns

To Cost of Production 1,23,000 (58,50,000 – 21,000) 58,29,000

(Transfer from Manufacturing A/c) 50,76,000 By Closing Stock 4,11,000

To Gross Profi t c/d 10,41,000

62,40,000 62,40,000

Contd..

150 LOVELY PROFESSIONAL UNIVERSITY