Page 151 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 151

Unit 12: Final Accounts

Carriage Inwards 10,000 Notes

Marine insurance on purchase 6,000

Other direct expenses 4,000

Sales Returns 30,000

st

Stock as on 31 March 2005 10,000

In this problem, return outwards and inwards are given in addition to cash and credit purchases

and sales of a fi rm to find out the net purchases and the net sales of the fi rm.

Net Sales = Cash Sales+ Credit Sales- Sales Returns

Net Purchases = Cash Purchases + Credit Purchases-Purchase Returns

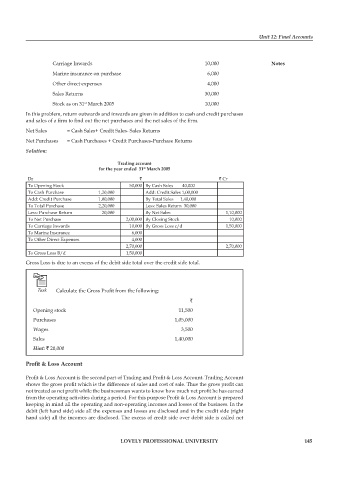

Solution:

Trading account

for the year ended 31 March 2005

st

Dr ` ` Cr

To Opening Stock 50,000 By Cash Sales 40,000

To Cash Purchase 1,20,000 Add: Credit Sales 1,00,000

Add: Credit Purchase 1,00,000 By Total Sales 1,40,000

To Total Purchase 2,20,000 Less: Sales Return 30,000

Less: Purchase Return 20,000 By Net Sales 1,10,000

To Net Purchase 2,00,000 By Closing Stock 10,000

To Carriage Inwards 10,000 By Gross Loss c/d 1,50,000

To Marine Insurance 6,000

To Other Direct Expenses 4,000

2,70,000 2,70,000

To Gross Loss B/d 1,50,000

Gross Loss is due to an excess of the debit side total over the credit side total.

Task Calculate the Gross Profit from the following:

`

Opening stock 11,500

Purchases 1,05,000

Wages 3,500

Sales 1,40,000

Hint: ` 20,000

Profit & Loss Account

Profit & Loss Account is the second part of Trading and Profit & Loss Account. Trading Account

shows the gross profit which is the difference of sales and cost of sale. Thus the gross profi t can

not treated as net profit while the businessman wants to know how much net profit he has earned

from the operating activities during a period. For this purpose Profit & Loss Account is prepared

keeping in mind all the operating and non-operating incomes and losses of the business. In the

debit (left hand side) side all the expenses and losses are disclosed and in the credit side (right

hand side) all the incomes are disclosed. The excess of credit side over debit side is called net

LOVELY PROFESSIONAL UNIVERSITY 145