Page 154 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 154

Financial Accounting-I

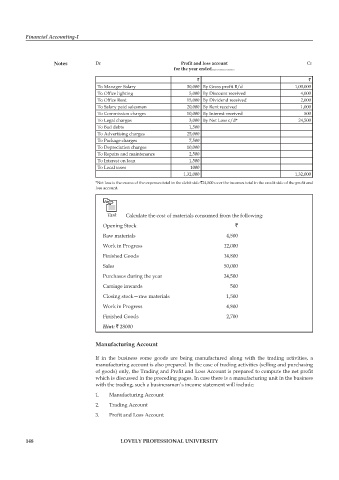

Notes Dr Profit and loss account Cr

for the year ended....................

` `

To Manager Salary 30,000 By Gross profi t B/d 1,00,000

To Office lighting 5,000 By Discount received 4,000

To Office Rent 15,000 By Dividend received 2,000

To Salary paid salesman 20,000 By Rent received 1,000

To Commission charges 10,000 By Interest received 500

To Legal charges 3,000 By Net Loss c/d* 24,500

To Bad debts 1,500

To Advertising charges 25,000

To Package charges 7,500

To Depreciation charges 10,000

To Repairs and maintenance 2,500

To Interest on loan 1,500

To Local taxes 1000

1,32,000 1,32,000

*Net loss is the excess of the expenses total in the debit side `24,500 over the incomes total in the credit side of the profi t and

loss account.

Task Calculate the cost of materials consumed from the following:

Opening Stock `

Raw materials 4,500

Work in Progress 12,000

Finished Goods 14,800

Sales 50,000

Purchases during the year 24,500

Carriage inwards 500

Closing stock—raw materials 1,500

Work in Progress 4,800

Finished Goods 2,700

Hint: ` 28000

Manufacturing Account

If in the business some goods are being manufactured along with the trading activities, a

manufacturing account is also prepared. In the case of trading activities (selling and purchasing

of goods) only, the Trading and Profit and Loss Account is prepared to compute the net profi t

which is discussed in the preceding pages. In case there is a manufacturing unit in the business

with the trading, such a businessman’s income statement will include:

1. Manufacturing Account

2. Trading Account

3. Profit and Loss Account

148 LOVELY PROFESSIONAL UNIVERSITY