Page 172 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 172

Financial Accounting-I

Notes (c) Stock valued at `10,000 was destroyed by fire but insurance company admitted a

claim of 8,500 only and the claim is not yet paid.

(d) Wages include `2,000 for installation of a new machinery on 1st Dec, 2005

(e) Depreciate the machinery at 10% per annum

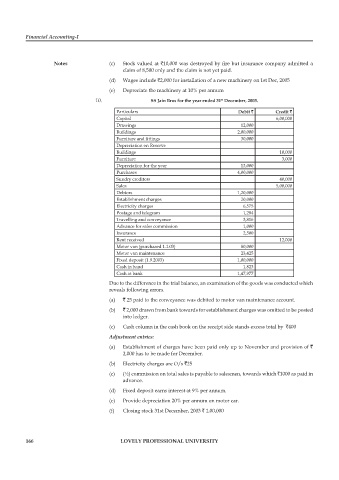

10. SS Jain Bros for the year ended 31 December, 2003.

st

Particulars Debit ` Credit `

Capital 6,00,000

Drawings 12,000

Buildings 2,00,000

Furniture and fi ttings 30,000

Depreciation on Reserve

Buildings 10,000

Furniture 3,000

Depreciation for the year 13,000

Purchases 4,00,000

Sundry creditors 40,000

Sales 5,00,000

Debtors 1,20,000

Establishment charges 20,000

Electricity charges 6,575

Postage and telegram 1,284

Travelling and conveyance 3,816

Advance for sales commission 1,000

Insurance 2,500

Rent received 12,000

Motor van (purchased 1.1.03) 80,000

Motor van maintenance 23,425

Fixed deposit (1.9.2003) 1,00,000

Cash in hand 1,823

Cash at bank 1,47,977

Due to the difference in the trial balance, an examination of the goods was conducted which

reveals following errors.

(a) ` 25 paid to the conveyance was debited to motor van maintenance account.

(b) ` 2,000 drawn from bank towards for establishment charges was omitted to be posted

into ledger.

(c) Cash column in the cash book on the receipt side stands excess total by `400

Adjustment entries:

(a) Establishment of charges have been paid only up to November and provision of `

2,000 has to be made for December.

(b) Electricity charges are O/s `25

(c) (½) commission on total sales is payable to salesmen, towards which `1000 as paid in

advance.

(d) Fixed deposit earns interest at 9% per annum.

(e) Provide depreciation 20% per annum on motor car.

(f) Closing stock 31st December, 2003 ` 1,00,000

166 LOVELY PROFESSIONAL UNIVERSITY