Page 176 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 176

Financial Accounting-I

Notes 5. Direct receipts by the bank: Sometimes, the interest on debentures or dividends on shares

held by the account holder is directly deposited by the company through Electronic

Clearing System (ECS). But the firm does not get the information till it receives the bank

statement. As a consequence, the firm enters it in its cash book on a date later than the date

it is recorded by the bank. As a result, the balance as per cash book and pass book will

differ.

6. Direct payments made by the bank: Sometimes, bank makes certain payments on behalf of

the customer as per standing instructions. Telephone bills, rent, insurance premium, taxes,

etc are some of the expenses. These expenses are directly paid by the bank and debited

to the firm’s account immediately after their payment but the firm will record the same

on receiving information from the bank in the form of Pass Book or bank statement. As

a result, the balance of the pass book is less than that of the balance shown in the bank

column of the cash book.

7. Dishonour of cheques/bill discounted: If a cheque deposited by the firm or bill receivable

discounted with the bank is dishonoured, the same is debited to firm’s account by the bank.

But the firm records the same when it receives the information from the bank. As a result,

the balance as per cash book and that of pass book will differ.

8. Errors committed in recording transactions by the fi rm: There may be certain errors from the

firm’s side, e.g., omission or wrong recording of transactions relating to cheques deposited,

cheques issued and wrong balancing etc. In this case, there would be a difference between

the balances as per Cash Book and as per Pass Book.

9. Errors committed in recording transactions by the Bank: Sometimes, bank may also commit

errors, e.g., omission or wrong recording of transactions relating to cheques deposited etc.

As a result, the balance of the bank pass book and cash book will not agree.

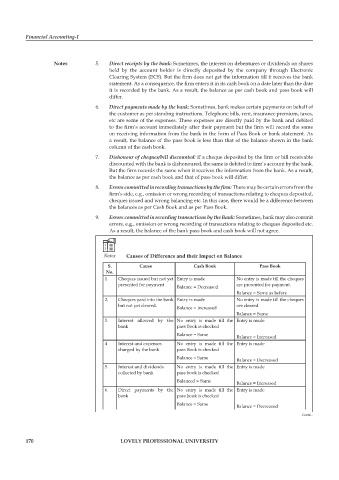

Notes Causes of Difference and their Impact on Balance

S. Cause Cash Book Pass Book

No.

1. Cheques issued but not yet Entry is made No entry is made till the cheques

presented for payment Balance = Decreased are presented for payment.

Balance = Same as before

2. Cheques paid into the bank Entry is made No entry is made till the cheques

but not yet cleared. are cleared

Balance = Increased

Balance = Same

3. Interest allowed by the No entry is made till the Entry is made

bank pass Book is checked

Balance = Same

Balance = Increased

4. Interest and expenses No entry is made till the Entry is made

charged by the bank pass Book is checked

Balance = Same

Balance = Decreased

5. Interest and dividends No entry is made till the Entry is made

collected by bank pass book is checked

Balanced = Same Balance = Increased

6. Direct payments by the No entry is made till the Entry is made

bank pass book is checked

Balance = Same

Balance = Decreased

Contd...

170 LOVELY PROFESSIONAL UNIVERSITY