Page 179 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 179

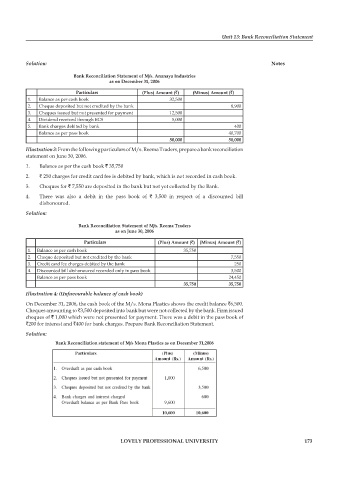

Unit 13: Bank Reconciliation Statement

Solution: Notes

Bank Reconciliation Statement of M/s. Ananaya Industries

as on December 31, 2006

Particulars (Plus) Amount (`) (Minus) Amount (`)

1. Balance as per cash book 32,500

2. Cheque deposited but not credited by the bank 8,900

3. Cheques issued but not presented for payment 12,500

4. Dividend received through ECS 5,000

5. Bank charges debited by bank 400

Balance as per pass book 40,700

50,000 50,000

Illustration 3: From the following particulars of M/s. Reema Traders, prepare a bank reconciliation

statement on June 30, 2006.

1. Balance as per the cash book ` 35,750

2. ` 250 charges for credit card fee is debited by bank, which is not recorded in cash book.

3. Cheques for ` 7,550 are deposited in the bank but not yet collected by the Bank.

4. There was also a debit in the pass book of ` 3,500 in respect of a discounted bill

dishonoured.

Solution:

Bank Reconciliation Statement of M/s. Reema Traders

as on June 30, 2006

Particulars (Plus) Amount (`) (Minus) Amount (`)

1. Balance as per cash book 35,750

2. Cheque deposited but not credited by the bank 7,550

3. Credit card fee charges debited by the bank 250

4. Discounted bill dishonoured recorded only in pass book 3,500

Balance as per pass book 24,450

35,750 35,750

Illustration 4: (Unfavourable balance of cash book)

On December 31, 2006, the cash book of the M/s. Mona Plastics shows the credit balance `6,500.

Cheques amounting to `3,500 deposited into bank but were not collected by the bank. Firm issued

cheques of ` 1,000 which were not presented for payment. There was a debit in the pass book of

`200 for interest and `400 for bank charges. Prepare Bank Reconciliation Statement.

Solution:

Bank Reconciliation statement of M/s Mona Plastics as on December 31,2006

LOVELY PROFESSIONAL UNIVERSITY 173