Page 184 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 184

Financial Accounting-I

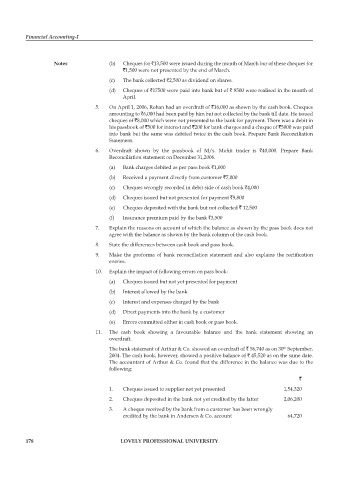

Notes (b) Cheques for `13,500 were issued during the month of March but of these cheques for

`1,500 were not presented by the end of March.

(c) The bank collected `2,500 as dividend on shares.

(d) Cheques of `17500 were paid into bank but of ` 8500 were realised in the month of

April.

5. On April 1, 2006, Rohan had an overdraft of `16,000 as shown by the cash book. Cheques

amounting to `6,000 had been paid by him but not collected by the bank till date. He issued

cheques of `8,000 which were not presented to the bank for payment. There was a debit in

his passbook of `500 for interest and `200 for bank charges and a cheque of `5000 was paid

into bank but the same was debited twice in the cash book. Prepare Bank Reconciliation

Statement.

6. Overdraft shown by the passbook of M/s. Mohit trader is `40,000. Prepare Bank

Reconciliation statement on December 31,2006.

(a) Bank charges debited as per pass book `1,000

(b) Received a payment directly from customer `7,000

(c) Cheques wrongly recorded in debit side of cash book `4,000

(d) Cheques issued but not presented for payment `9,800

(e) Cheques deposited with the bank but not collected ` 12,500

(f) Insurance premium paid by the bank `3,500

7. Explain the reasons on account of which the balance as shown by the pass book does not

agree with the balance as shown by the bank column of the cash book.

8. State the differences between cash book and pass book.

9. Make the proforma of bank reconciliation statement and also explains the rectifi cation

entries.

10. Explain the impact of following errors on pass book:

(a) Cheques issued but not yet presented for payment

(b) Interest allowed by the bank

(c) Interest and expenses charged by the bank

(d) Direct payments into the bank by a customer

(e) Errors committed either in cash book or pass book.

11. The cash book showing a favourable balance and the bank statement showing an

overdraft.

The bank statement of Arthur & Co. showed an overdraft of ` 56,740 as on 30 September,

th

2004. The cash book, however, showed a positive balance of ` 45,520 as on the same date.

The accountant of Arthur & Co. found that the difference in the balance was due to the

following:

`

1. Cheques issued to supplier not yet presented 1,54,320

2. Cheques deposited in the bank not yet credited by the latter 2,06,200

3. A cheque received by the bank from a customer has been wrongly

credited by the bank in Andersen & Co. account 64,720

178 LOVELY PROFESSIONAL UNIVERSITY