Page 108 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 108

Unit 4: Buy Back of Securities by Private Limited and Unlisted Public Limited Companies

The company had a balance of 28,000 in its Profit and Loss Account on 1st September, Notes

1982 the company decided to issue 5,000 fully paid bonus shares of 10 each for allotment

to equity share-holders in the ratio of one equity share for every four shares hold. It has

also a reserve of 1,10,000.

Record the necessary journal entries in the books of the company.

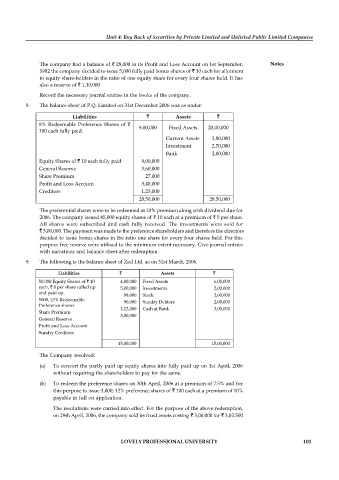

8. The balance sheet of P.Q. Limited on 31st December 2006 was as under:

Liabilities Assets

8% Redeemable Preference Shares of

9,00,000 Fixed Assets 20,00,000

100 each fully paid.

Current Assets 3,80,000

Investment 2,70,000

Bank 2,00,000

Equity Shares of 10 each fully paid 9,00,000

General Reserve 3,60,000

Share Premium 27,000

Profit and Loss Account 5,40,000

Creditors 1,23,000

28,50,000 28,50,000

The preferential shares were to be redeemed at 10% premium along with dividend due for

2006. The company issued 45,000 equity shares of 10 each at a premium of 5 per share.

All shares were subscribed and cash fully received. The investments were sold for

3,00,000. The payment was made to the preference shareholders and therefore the directors

decided to issue bonus shares in the ratio one share for every four shares held. For this

purpose free reserve were utilised to the minimum extent necessary. Give journal entries

with narrations and balance sheet after redemption.

9. The following is the balance sheet of Zed Ltd. as on 31st March, 2006.

Liabilities Assets

50,000 Equity Shares of 10 4,00,000 Fixed Assets 6,00,000

each, 8 per share called up 5,00,000 Investments 2,00,000

and paid up.

98,000 Stock 2,00,000

5000, 13% Redeemable 90,000 Sundry Debtors 2,00,000

Preference shares

1,12,000 Cash at Bank 3,00,000

Share Premium

3,00,000

General Reserve

Profit and Loss Account

Sundry Creditors

15,00,000 15,00,000

The Company resolved:

(a) To convert the partly paid up equity shares into fully paid up on 1st April, 2006

without requiring the shareholders to pay for the same.

(b) To redeem the preference shares on 30th April, 2006 at a premium of 7.5% and for

this purpose to issue 3,000; 12% preference shares of 100 each at a premium of 10%

payable in full on application.

The resolutions were carried into effect. For the purpose of the above redemption,

on 29th April, 2006, the company sold its fixed assets costing 3,00,000 for 3,82,500

LOVELY PROFESSIONAL UNIVERSITY 101