Page 104 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 104

Unit 4: Buy Back of Securities by Private Limited and Unlisted Public Limited Companies

5. Stay below the 500-shareholder threshold. Private firms that have 500 or more Notes

shareholders can be required to make public filings similar to public companies.

As principal owner of your business, you have to be concerned with any corporate stock

redemption, for the following reasons:

Many states restrict or prohibit the purchase of stock by the company from its

stockholders, principally depending on the availability of cash and capital surplus

within the company to effect the stock repurchase. Basically, you cannot “impair”

the capital account and solvency of the business by repurchasing “equity” securities.

Other stockholders may complain because of the effect on the corporation,

particularly its balance sheet. The operating agreement of the company may also

require that such a transaction be approved by some percentage of the shareholders.

You may be accused of unfair dealing if you don’t offer all owners the right to sell

their stock back to the company at the same time, price and terms.

Your creditors may object since the stockholders’ equity account drops after a

redemption. For this reason, most loan agreements prohibit or restrict a company’s

repurchase of equity shares or interest.

You may be sued by the selling stockholder if you know of certain facts that affect

the value of the stock and these facts are unknown to the seller (material insider

information) at the time of the stock repurchase.

Effect on the Company

Below is a description of the subject business owner’s analysis, with explanatory remarks.

Note that this approach can be applied to companies with other forms of ownership,

including S-corporations, partnerships and limited liability corporations (LLCs). Let’s

start with the stockholders’ equity account, in which there are 100,000 shares of common

stock outstanding.

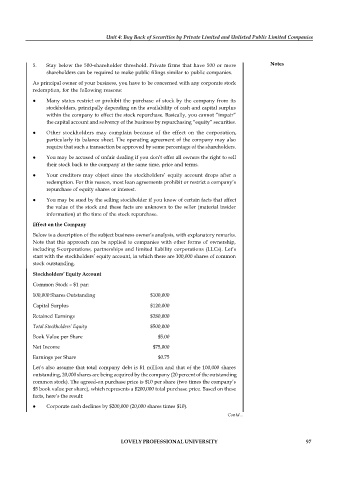

Stockholders’ Equity Account

Common Stock – $1 par:

100,000 Shares Outstanding $100,000

Capital Surplus $120,000

Retained Earnings $280,000

Total Stockholders’ Equity $500,000

Book Value per Share $5.00

Net Income $75,000

Earnings per Share $0.75

Let’s also assume that total company debt is $1 million and that of the 100,000 shares

outstanding, 20,000 shares are being acquired by the company (20 percent of the outstanding

common stock). The agreed-on purchase price is $10 per share (two times the company’s

$5 book value per share), which represents a $200,000 total purchase price. Based on these

facts, here’s the result:

Corporate cash declines by $200,000 (20,000 shares times $10).

Contd...

LOVELY PROFESSIONAL UNIVERSITY 97