Page 100 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 100

Unit 4: Buy Back of Securities by Private Limited and Unlisted Public Limited Companies

On 1st April, 2009 the company redeemed all of its preference shares at a premium of 10% and Notes

bought back 25% of its equity shares @ 20 per share. In order to make cash available, the

company sold all the investments for 3, 150 lakh and raised a bank loan amounting to 2,000

lakhs on the security of the company’s plant.

Pass journal entries for all the above mentioned transactions including cash transactions and

prepare the company’s balance sheet immediately thereafter. The amount of securities premium

has been utilized to the maximum extent allowed by law.

Solution:

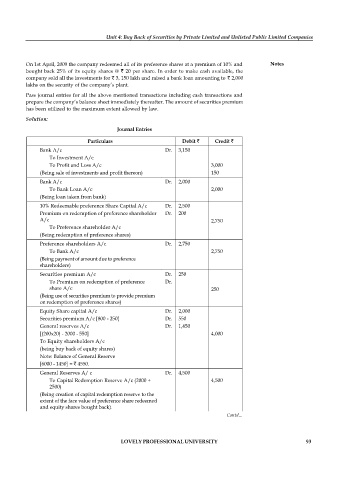

Journal Entries

Particulars Debit Credit

Bank A/c Dr. 3,150

To Investment A/c

To Profit and Loss A/c 3,000

(Being sale of investments and profit thereon) 150

Bank A/c Dr. 2,000

To Bank Loan A/c 2,000

(Being loan taken from bank)

10% Redeemable preference Share Capital A/c Dr. 2,500

Premium on redemption of preference shareholder Dr. 200

A/c 2,750

To Preference shareholder A/c

(Being redemption of preference shares)

Preference shareholders A/c Dr. 2,750

To Bank A/c 2,750

(Being payment of amount due to preference

shareholders)

Securities premium A/c Dr. 250

To Premium on redemption of preference Dr.

share A/c 250

(Being use of securities premium to provide premium

on redemption of preference shares)

Equity Share capital A/c Dr. 2,000

Securities premium A/c [800 - 250] Dr. 550

General reserves A/c Dr. 1,450

[(200x20) - 2000 - 550] 4,000

To Equity shareholders A/c

(being buy back of equity shares)

Note: Balance of General Reserve

[6000 - 1450] = 4550.

General Reserves A/ c Dr. 4,500

To Capital Redemption Reserve A/c (2000 + 4,500

2500)

(Being creation of capital redemption reserve to the

extent of the face value of preference share redeemed

and equity shares bought back).

Note: Balance in General reserve as on 01.04.09 Contd...

(4550 - 4500) = 50.

Equity shareholders A/c Dr. 4,000

To Bank A/c 4,000

LOVELY PROFESSIONAL UNIVERSITY 93

(Being payment of amount due to equity

shareholders).

Note: Cash at Bank

[1650+3150+2000-2750-4000] = 50