Page 96 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 96

Unit 4: Buy Back of Securities by Private Limited and Unlisted Public Limited Companies

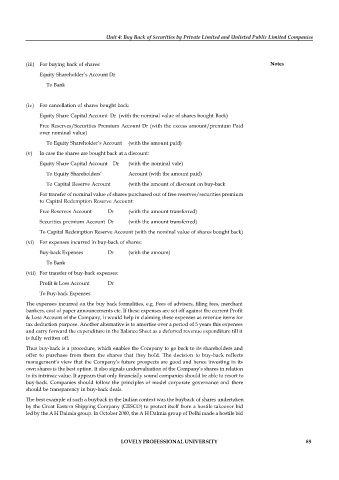

(iii) For buying back of shares: Notes

Equity Shareholder’s Account Dr

To Bank

(iv) For cancellation of shares bought back:

Equity Share Capital Account Dr (with the nominal value of shares bought Back)

Free Reserves/Securities Premium Account Dr (with the excess amount/premium Paid

over nominal value)

To Equity Shareholder’s Account (with the amount paid)

(v) In case the shares are bought back at a discount:

Equity Share Capital Account Dr (with the nominal vale)

To Equity Shareholders’ Account (with the amount paid)

To Capital Reserve Account (with the amount of discount on buy-back

For transfer of nominal value of shares purchased out of free reserves/securities premium

to Capital Redemption Reserve Account:

Free Reserves Account Dr (with the amount transferred)

Securities premium Account Dr (with the amount transferred)

To Capital Redemption Reserve Account (with the nominal value of shares bought back)

(vi) For expenses incurred in buy-back of shares:

Buy-back Expenses Dr (with the amount)

To Bank

(vii) For transfer of buy-back expenses:

Profit & Loss Account Dr

To Buy-back Expenses

The expenses incurred on the buy back formalities, e.g. Fees of advisers, filing fees, merchant

bankers, cost of paper announcements etc. If these expenses are set off against the current Profit

& Loss Account of the Company, it would help in claiming these expenses as revenue items for

tax deduction purpose. Another alternative is to amortise over a period of 5 years this expenses

and carry forward the expenditure in the Balance Sheet as a deferred revenue expenditure till it

is fully written off.

Thus buy-back is a procedure, which enables the Company to go back to its shareholders and

offer to purchase from them the shares that they hold. The decision to buy-back reflects

management’s view that the Company’s future prospects are good and hence investing in its

own shares is the best option. It also signals undervaluation of the Company’s shares in relation

to its intrinsic value. It appears that only financially sound companies should be able to resort to

buy-back. Companies should follow the principles of model corporate governance and there

should be transparency in buy-back deals.

The best example of such a buyback in the Indian context was the buyback of shares undertaken

by the Great Eastern Shipping Company (GESCO) to protect itself from a hostile takeover bid

led by the A H Dalmia group. In October 2000, the A H Dalmia group of Delhi made a hostile bid

LOVELY PROFESSIONAL UNIVERSITY 89