Page 98 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 98

Sources of Funds

Share capital:

Authorised

100

Issued:

12% redeemable preference shares of ` 100 each fully paid (` in crores)

75

Equity shares of ` 10 each fully paid 25 100

Reserves and surplus

Capital Reserve 15

25

Securities Premium Unit 4: Buy Back of Securities by Private Limited and Unlisted Public Limited Companies

Revenue Reserves 260 300

400

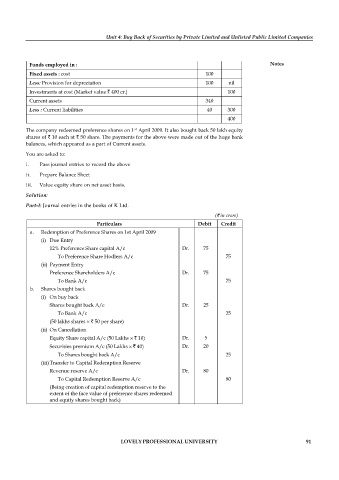

Funds employed in : Notes

Fixed assets : cost 100

Less: Provision for depreciation 100 nil

Investments at cost (Market value ` 400 cr.) 100

Current assets 340

Less : Current liabilities 40 300

400

st

The company redeemed preference shares on 1 April 2009. It also bought back 50 lakh equity

shares of ` 10 each at ` 50 share. The payments for the above were made out of the huge bank

balances, which appeared as a part of Current assets.

You are asked to:

i. Pass journal entries to record the above

ii. Prepare Balance Sheet

iii. Value equity share on net asset basis.

Solution:

Part-I: Journal entries in the books of K Ltd.

(` in crore)

Particulars Debit Credit

a. Redemption of Preference Shares on 1st April 2009

(i) Due Entry

12% Preference Share capital A/c Dr. 75

To Preference Share Hodlers A/c 75

(ii) Payment Entry

Preference Shareholders A/c Dr. 75

To Bank A/c 75

b. Shares bought back

(i) On buy back

Shares bought back A/c Dr. 25

To Bank A/c 25

(50 lakhs shares ` 50 per share)

(ii) On Cancellation

Equity Share capital A/c (50 Lakhs ` 10) Dr. 5

Securities premium A/c (50 Lakhs ` 40) Dr. 20

To Shares bought back A/c 25

(iii) Transfer to Capital Redemption Reserve

Revenue reserve A/c Dr. 80

To Capital Redemption Reserve A/c 80

(Being creation of capital redemption reserve to the

extent of the face value of preference shares redeemed

and equity shares bought back)

LOVELY PROFESSIONAL UNIVERSITY 91