Page 102 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 102

Unit 4: Buy Back of Securities by Private Limited and Unlisted Public Limited Companies

Notes

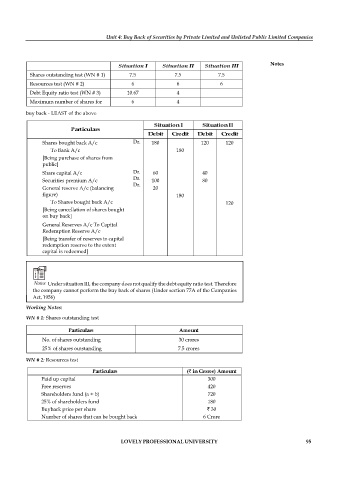

Situation I Situation II Situation III

Shares outstanding test (WN # 1) 7.5 7.5 7.5

Resources test (WN # 2) 6 6 6

Debt Equity ratio test (WN # 3) 10.67 4

Maximum number of shares for 6 4

buy back - LEAST of the above

Situation I Situation II

Particulars

Debit Credit Debit Credit

Shares bought back A/c Dr. 180 120 120

To Bank A/c 180

[Being purchase of shares from

public]

Share capital A/c Dr. 60 40

Dr.

Securities premium A/c 100 80

Dr.

General reserve A/c (balancing 20

figure) 180

To Shares bought back A/c 120

[Being cancellation of shares bought

on buy back]

General Reserves A/c To Capital

Redemption Reserve A/c

[Being transfer of reserves to capital

redemption reserve to the extent

capital is redeemed]

Notes Under situation III, the company does not qualify the debt equity ratio test. Therefore

the company cannot perform the buy back of shares (Under section 77A of the Companies

Act, 1956)

Working Notes:

WN # 1: Shares outstanding test

Particulars Amount

No. of shares outstanding 30 crores

25% of shares outstanding 7.5 crores

WN # 2: Resources test

Particulars ( in Crores) Amount

Paid up capital 300

Free reserves 420

Shareholders fund (a + b) 720

25% of shareholders fund 180

Buyback price per share 30

Number of shares that can be bought back 6 Crore

LOVELY PROFESSIONAL UNIVERSITY 95