Page 164 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 164

Unit 7: Debentures: Conditions of Issue of Debentures from Redemption Point of View

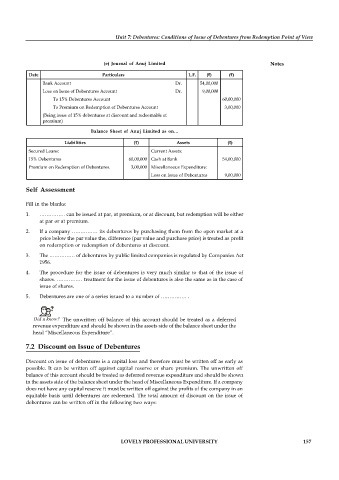

(e) Journal of Anuj Limited Notes

Date Particulars L.F. ( ) ( )

Bank Account Dr. 54,00,000

Loss on Issue of Debentures Account Dr. 9,00,000

To 15% Debentures Account 60,00,000

To Premium on Redemption of Debentures Account 3,00,000

(Being issue of 15% debentures at discount and redeemable at

premium)

Balance Sheet of Anuj Limited as on…

Liabilities ( ) Assets ( )

Secured Loans: Current Assets:

15% Debentures 60,00,000 Cash at Bank 54,00,000

Premium on Redemption of Debentures. 3,00,000 Miscellaneous Expenditure:

Loss on Issue of Debentures 9,00,000

Self Assessment

Fill in the blanks:

1. …………… can be issued at par, at premium, or at discount, but redemption will be either

at par or at premium.

2. If a company …………… its debentures by purchasing them from the open market at a

price below the par value the, difference (par value and purchase price) is treated as profit

on redemption or redemption of debentures at discount.

3. The …………… of debentures by public limited companies is regulated by Companies Act

1956.

4. The procedure for the issue of debentures is very much similar to that of the issue of

shares. …………… treatment for the issue of debentures is also the same as in the case of

issue of shares.

5. Debentures are one of a series issued to a number of …………… .

Did u know? The unwritten off balance of this account should be treated as a deferred

revenue expenditure and should be shown in the assets side of the balance sheet under the

head “Miscellaneous Expenditure”.

7.2 Discount on Issue of Debentures

Discount on issue of debentures is a capital loss and therefore must be written off as early as

possible. It can be written off against capital reserve or share premium. The unwritten off

balance of this account should be treated as deferred revenue expenditure and should be shown

in the assets side of the balance sheet under the head of Miscellaneous Expenditure. If a company

does not have any capital reserve it must be written off against the profits of the company in an

equitable basis until debentures are redeemed. The total amount of discount on the issue of

debentures can be written off in the following two ways:

LOVELY PROFESSIONAL UNIVERSITY 157