Page 165 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 165

Accounting for Companies-I

Notes (i) When the redemption of debentures is in lump sum after specified period: Equal Instalment

Method – When debentures are redeemable at the end of a specified period, total discount

on the issue of debentures is spread over the life of debentures equally.

For example, if total discount allowed is ` 15,000 and debentures are redeemable at the

end of fifteen years, total discount will be divided by 15 and the amount so arrived

15,000

(i.e. = 1,000) will be transferred to Profit and Loss account every year for 15

`

15

years. Thus at the end of 15 years, the total amount of discount will be eliminated from

books. This method is suitable only when debentures are redeemable at the expiry of a

specified period.

(ii) When redemption of debentures is made in instalments: Proportion Method – In such case,

the total amount of discount on issue of debentures should be written off in the proportion

to the benefit received from the money collected by the issue of debentures or outstanding

balance every year. The reason is simple: the years which enjoy the use of the larger

proportion of cash should bear the larger proportion of discount.

Note It is to be noted that “premium on redemption of debentures account” is a personal

account, because it is the liability of the company to pay the Debenture-holder at a premium

as per the condition of redemption.

Accounting Treatment: When discount on issue of debentures is written off against the profits of

the company, the following journal entry is passed:

Profit and Loss Account Dr.

To Discount on Issue of Debentures Account.

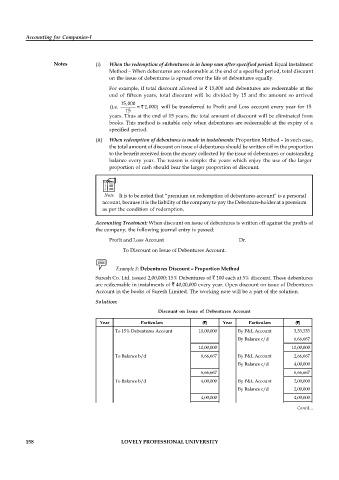

Example 3: Debentures Discount – Proportion Method

Suresh Co. Ltd. issued 2,00,000; 15% Debentures of ` 100 each at 5% discount. These debentures

are redeemable in instalments of ` 40,00,000 every year. Open discount on issue of Debentures

Account in the books of Suresh Limited. The working note will be a part of the solution.

Solution:

Discount on Issue of Debentures Account

Year Particulars (`) Year Particulars (`)

To 15% Debentures Account 10,00,000 By P&L Account 3,33,333

By Balance c/d 6,66,667

10,00,000 10,00,000

To Balance b/d 6,66,667 By P&L Account 2,66,667

By Balance c/d 4,00,000

6,66,667 6,66,667

To Balance b/d 4,00,000 By P&L Account 2,00,000

By Balance c/d 2,00,000

4,00,000 4,00,000

To Balance b/d 2,00,000 By P&L Account 1,33,333

Contd...

By Balance c/d 66,667

2,00,000 2,00,000

To Balance b/d 66,667 By P&L Account 66,667

158 LOVELY PROFESSIONAL UNIVERSITY

66,667 66,667