Page 193 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 193

Accounting for Companies-I

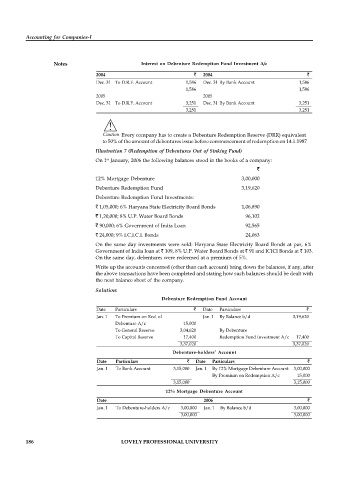

Notes Interest on Debenture Redemption Fund Investment A/c

2004 ` 2004 `

Dec. 31 To D.R.F. Account 1,586 Dec. 31 By Bank Account 1,586

1,586 1,586

2005 2005

Dec. 31 To D.R.F. Account 3,251 Dec. 31 By Bank Account 3,251

3,251 3,251

!

Caution Every company has to create a Debenture Redemption Reserve (DRR) equivalent

to 50% of the amount of debentures issue before commencement of redemption on 14.1.1987

Illustration 7 (Redemption of Debentures Out of Sinking Fund)

st

On 1 January, 2006 the following balances stood in the books of a company:

`

12% Mortgage Debenture 3,00,000

Debenture Redemption Fund 3,19,620

Debenture Redemption Fund Investments:

` 1,05,000; 6% Haryana State Electricity Board Bonds 1,06,890

` 1,20,000; 8% U.P. Water Board Bonds 96,102

` 90,000; 6% Government of India Loan 92,565

` 24,000; 9% I.C.I.C.I. Bonds 24,063

On the same day investments were sold: Haryana State Electricity Board Bonds at par, 6%

Government of India loan at ` 109, 8% U.P. Water Board Bonds at ` 91 and ICICI Bonds at ` 103.

On the same day, debentures were redeemed at a premium of 5%.

Write up the accounts concerned (other than cash account) bring down the balances, if any, after

the above transactions have been completed and stating how such balances should be dealt with

the next balance sheet of the company.

Solution:

Debenture Redemption Fund Account

Date Particulars ` Date Particulars `

Jan. 1 To Premium on Red. of Jan. 1 By Balance b/d 3,19,620

Debenture A/c 15,000

To General Reserve 3,04,620 By Debenture

To Capital Reserve 17,400 Redemption Fund Investment A/c 17,400

3,37,020 3,37,020

Debenture-holders’ Account

Date Particulars ` Date Particulars `

Jan. 1 To Bank Account 3,15,000 Jan. 1 By 12% Mortgage Debenture Account 3,00,000

By Premium on Redemption A/c 15,000

3,15,000 3,15,000

12% Mortgage Debenture Account

Date 2006 `

Jan. 1 To Debenture-holders A/c 3,00,000 Jan. 1 By Balance b/d 3,00,000

3,00,000 3,00,000

186 LOVELY PROFESSIONAL UNIVERSITY