Page 194 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 194

Unit 8: Methods of Redemption–I

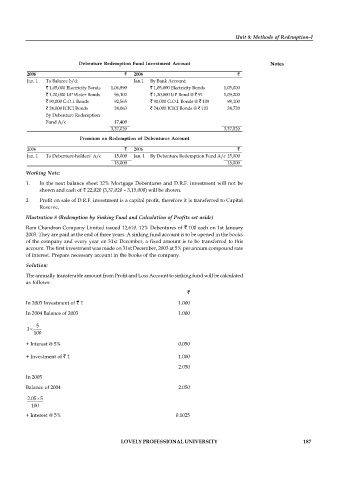

Debenture Redemption Fund Investment Account Notes

2006 2006

Jan. 1 To Balance b/d: Jan.1 By Bank Account:

1,05,000 Electricity Bonds 1,06,890 1,05,000 Electricity Bonds 1,05,000

1,20,000 UP Water Bonds 96,102 1,20,000 UP Bond @ 91 1,09,200

90,000 G.O.I. Bonds 92,565 90,000 G.O.I. Bonds @ 109 98,100

24,000 ICICI Bonds 24,063 24,000 ICICI Bonds @ 103 24,720

By Debenture Redemption

Fund A/c 17,400

3,37,020 3,37,020

Premium on Redemption of Debentures Account

2006 2006

Jan. 1 To Debenture-holders’ A/c 15,000 Jan. 1 By Debenture Redemption Fund A/c 15,000

15,000 15,000

Working Note:

1. In the next balance sheet 12% Mortgage Debentures and D.R.F. investment will not be

shown and cash of 22,020 (3,37,020 – 3,15,000) will be shown.

2. Profit on sale of D.R.F. investment is a capital profit, therefore it is transferred to Capital

Reserve.

Illustration 8 (Redemption by Sinking Fund and Calculation of Profits set aside)

Ram Chandran Company Limited issued 12,610. 12% Debentures of 100 each on 1st January

2003. They are paid at the end of three years. A sinking fund account is to be opened in the books

of the company and every year on 31st December, a fixed amount is to be transferred to this

account. The first investment was made on 31st December, 2003 at 5% per annum compound rate

of interest. Prepare necessary account in the books of the company.

Solution:

The annually transferable amount from Profit and Loss Account to sinking fund will be calculated

as follows:

In 2003 Investment of 1 1.000

In 2004 Balance of 2003 1.000

5

1

100

+ Interest @ 5% 0.050

+ Investment of 1 1.000

2.050

In 2005

Balance of 2004 2.050

2.05 5

100

+ Interest @ 5% 0.1025

LOVELY PROFESSIONAL UNIVERSITY 187