Page 225 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 225

Accounting for Companies-I

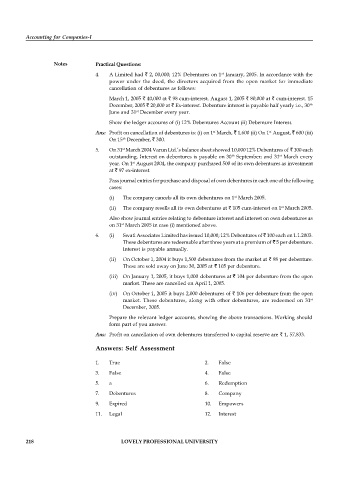

Notes Practical Questions:

st

4. A Limited had 2, 00,000; 12% Debentures on 1 January, 2005. In accordance with the

power under the deed, the directors acquired from the open market for immediate

cancellation of debentures as follows:

March 1, 2005 40,000 at 98 cum-interest. August 1, 2005 80,000 at cum-interest. 15

December, 2005 20,000 at Ex-interest. Debenture interest is payable half yearly i.e., 30 th

st

June and 31 December every year.

Show the ledger accounts of (i) 12% Debentures Account (ii) Debenture Interest.

Ans: Profit on cancellation of debentures is: (i) on 1 March, 1,600 (ii) On 1 August, 600 (iii)

st

st

On 15 December, 300.

th

5. On 31 March 2004 Varun Ltd.’s balance sheet showed 10,000 12% Debentures of 100 each

st

st

outstanding. Interest on debentures is payable on 30 September; and 31 March every

th

year. On 1 August 2004, the company purchased 500 of its own debentures as investment

st

at 97 ex-interest.

Pass journal entries for purchase and disposal of own debentures in each one of the following

cases:

(i) The company cancels all its own debentures on 1 March 2005.

st

(ii) The company resells all its own debentures at 105 cum-interest on 1 March 2005.

st

Also show journal entries relating to debenture interest and interest on own debentures as

st

on 31 March 2005 in case (i) mentioned above.

6. (i) Swati Associates Limited has issued 10,000; 12% Debentures of 100 each on 1.1.2003.

These debentures are redeemable after three years at a premium of 5 per debenture.

Interest is payable annually.

(ii) On October 1, 2004 it buys 1,500 debentures from the market at 98 per debenture.

These are sold away on June 30, 2005 at 105 per debenture.

(iii) On January 1, 2005, it buys 1,000 debentures at 104 per debenture from the open

market. These are cancelled on April 1, 2005.

(iv) On October 1, 2005 it buys 2,000 debentures of 106 per debenture from the open

market. These debentures, along with other debentures, are redeemed on 31 st

December, 2005.

Prepare the relevant ledger accounts, showing the above transactions. Working should

form part of you answer.

Ans: Profit on cancellation of own debentures transferred to capital reserve are 1, 57,833.

Answers: Self Assessment

1. True 2. False

3. False 4. False

5. a 6. Redemption

7. Debentures 8. Company

9. Expired 10. Empowers

11. Legal 12. Interest

218 LOVELY PROFESSIONAL UNIVERSITY