Page 222 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 222

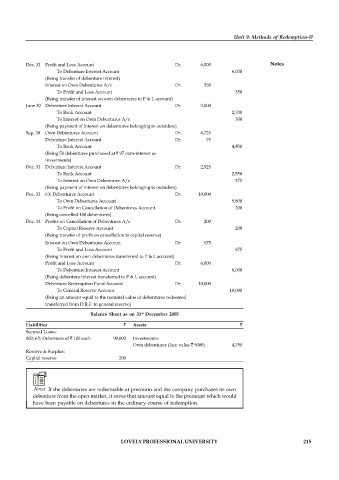

Particulars

Dr.

July

To 6% Debentures Account

(Being issue of 1,000 debentures of 100 each)

Dec. 31 Debenture Interest Account

Dr.

3,000

To Bank Account

3,000

(Being payment of debenture interest to debenture-holders)

Dec. 31 Profit and Loss Account

Dr.

3,000

3,000

To Debenture Interest A/c

(Being debenture interest transferred to P & L accounts)

2004

Dr.

May 31 Own Debentures Account

9,800

Debenture Interest Account

250

Dr.

To Bank Account

10,050

Date Bank Account L.F. 1,00,000 1,00,000

(Being 100 debentures purchased as investment @ 98 ex-interest)

June 30 Debenture Interest Account Dr. 2,750

To Bank Account 2,700

To Interest on Own Debentures Account 50

(Being payment of interest on 900 debentures belonging to outsiders)

Dec. 31 Debenture Interest Account Dr. 3,000 Unit 9: Methods of Redemption-II

To Bank Account 2,700

To Interest on Own Debentures A/c 300

(Being payment of interest on debentures belonging to outsiders)

Dec. 31 Profit and Loss Account Dr. 6,000 Notes

To Debenture Interest Account 6,000

(Being transfer of debenture interest)

Interest on Own Debentures A/c Dr. 350

To Profit and Loss Account 350

(Being transfer of interest on own debentures to P & L account)

June 30 Debenture Interest Account Dr. 3,000

To Bank Account 2,700

To Interest on Own Debentures A/c 300

(Being payment of interest on debentures belonging to outsiders)

Sep. 30 Own Debentures Account Dr. 4,725

Debenture Interest Account Dr. 75

To Bank Account 4,850

(Being 50 debentures purchased at 97 cum-interest as

investments)

Dec. 31 Debenture Interest Account Dr. 2,925

To Bank Account 2,550

To Interest on Own Debentures A/c 375

(Being payment of interest on debentures belonging to outsiders)

Dec. 31 6% Debentures Account Dr. 10,000

To Own Debentures Account 9,800

To Profit on Cancellation of Debentures Account. 200

(Being cancelled 100 debentures)

Dec. 31 Profits on Cancellation of Debentures A/c Dr. 200

To Capital Reserve Account 200

(Being transfer of profit on cancellation to capital reserve)

Interest on Own Debentures Account Dr. 675

To Profit and Loss Account 675

(Being interest on own debentures transferred to P & L account)

Profit and Loss Account Dr. 6,000

To Debenture Interest Account 6,000

(Being debenture interest transferred to P & L account)

Debenture Redemption Fund Account Dr. 10,000

To General Reserve Account 10,000

(Being an amount equal to the nominal value of debentures redeemed

transferred from D.R.F. to general reserve)

st

Balance Sheet as on 31 December 2005

Liabilities Assets

Secured Loans:

900; 6% Debenture of 100 each 90,000 Investments:

Own debentures (face value 5000) 4,750

Reserve & Surplus:

Capital reserve 200

Notes If the debentures are redeemable at premium and the company purchases its own

debenture from the open market, it saves that amount equal to the premium which would

have been payable on debentures in the ordinary course of redemption.

LOVELY PROFESSIONAL UNIVERSITY 215