Page 247 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 247

Accounting for Companies-I

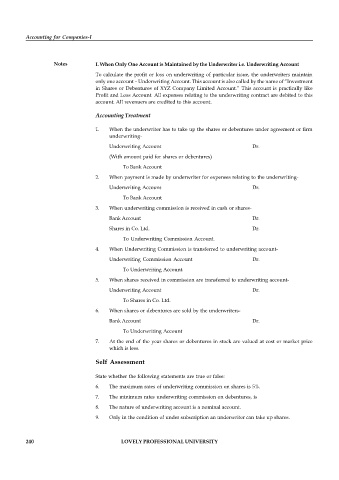

Notes I. When Only One Account is Maintained by the Underwriter i.e. Underwriting Account

To calculate the profit or loss on underwriting of particular issue, the underwriters maintain

only one account – Underwriting Account. This account is also called by the name of “Investment

in Shares or Debentures of XYZ Company Limited Account.” This account is practically like

Profit and Loss Account. All expenses relating to the underwriting contract are debited to this

account. All revenuers are credited to this account.

Accounting Treatment

1. When the underwriter has to take up the shares or debentures under agreement or firm

underwriting-

Underwriting Account Dr.

(With amount paid for shares or debentures)

To Bank Account

2. When payment is made by underwriter for expenses relating to the underwriting-

Underwriting Account Dr.

To Bank Account

3. When underwriting commission is received in cash or shares-

Bank Account Dr.

Shares in Co. Ltd. Dr.

To Underwriting Commission Account.

4. When Underwriting Commission is transferred to underwriting account-

Underwriting Commission Account Dr.

To Underwriting Account.

5. When shares received in commission are transferred to underwriting account-

Underwriting Account Dr.

To Shares in Co. Ltd.

6. When shares or debentures are sold by the underwriters-

Bank Account Dr.

To Underwriting Account

7. At the end of the year shares or debentures in stock are valued at cost or market price

which is less.

Self Assessment

State whether the following statements are true or false:

6. The maximum rates of underwriting commission on shares is 5%.

7. The minimum rates underwriting commission on debentures, is

8. The nature of underwriting account is a nominal account.

9. Only in the condition of under subscription an underwriter can take up shares.

240 LOVELY PROFESSIONAL UNIVERSITY