Page 242 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 242

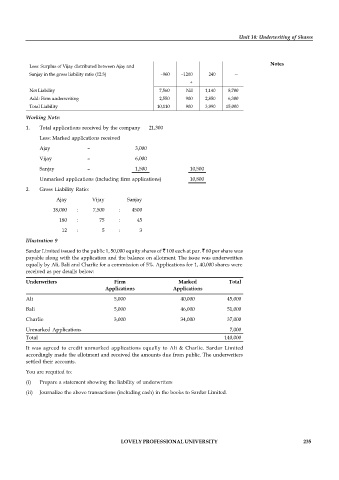

Underwriters Total

Particulars Ajay Vijay Sanjay

shares share share

Gross Liability 18,000 7,500 4,500 30,000

Less: Marked Applications given Resultant Liability 3,000 6,000 1,500 10,500

Unit 10: Underwriting of Shares

Less: Unmarked Application in gross 15,000 1500 3000 19500

Liability Ratio (12:5:3) 6,480 2,700 1,620 10,800

8,520 –1,200 1,380 8,700

Notes

Less: Surplus of Vijay distributed between Ajay and

Sanjay in the gross liability ratio (12:3) –960 –1200 240 —

+

Net Liability 7,560 Nil 1,140 8,700

Add: Firm underwriting 2,550 900 2,850 6,300

Total Liability 10,110 900 3,990 15,000

Working Note:

1. Total applications received by the company 21,300

Less: Marked applications received

Ajay – 3,000

Vijay – 6,000

Sanjay – 1,500 10,500

Unmarked applications (including firm applications) 10,800

2. Gross Liability Ratio:

Ajay Vijay Sanjay

18,000 : 7,500 : 4500

180 : 75 : 45

12 : 5 : 3

Illustration 9

Sardar Limited issued to the public 1, 50,000 equity shares of 100 each at par. 60 per share was

payable along with the application and the balance on allotment. The issue was underwritten

equally by Ali, Bali and Charlie for a commission of 5%. Applications for 1, 40,000 shares were

received as per details below:

Underwriters Firm Marked Total

Applications Applications

Ali 5,000 40,000 45,000

Bali 5,000 46,000 51,000

Charlie 3,000 34,000 37,000

Unmarked Applications 7,000

Total 140,000

It was agreed to credit unmarked applications equally to Ali & Charlie. Sardar Limited

accordingly made the allotment and received the amounts due from public. The underwriters

settled their accounts.

You are requited to:

(i) Prepare a statement showing the liability of underwriters

(ii) Journalize the above transactions (including cash) in the books to Sardar Limited.

LOVELY PROFESSIONAL UNIVERSITY 235