Page 240 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 240

Unit 10: Underwriting of Shares

4. From the balance (3) above, firm underwriting is deducted (firm underwriting can be Notes

deducted in the ratio of gross liability, or benefit may be given to individual underwriters.

It depends upon the agreement).

5. If any figure comes into minus (surplus) for any underwriter, that will be transferred to

other underwriters into their gross liability ratio. This will be the net liability.

6. To calculate the total liability of underwriters, firm underwriting is added to net liability.

Self Assessment

Fill in the blanks:

1. The maximum rate of underwriting commission in the case of debenture is ……………….

percent.

2. When an underwriter makes an agreement to take a certain number of shares, it is called

………….

3. Brokerage is fixed at …………… in respect of all types of public issues.

4. To calculate profit or loss on underwriting, ………….. is prepared by the underwriter.

5. Sub-Underwriting Commission is shown in the …………. side of the underwriting account.

Illustration 6

A Limited was formed with a capital of ` 20,00,000 divided into 1,00,000 shares of ` 20 each. The

whole amount was offered to the public. The company entered into as underwriting agreement

with the following individuals who have underwritten the whole issue as under:

P-30,000; Q-25,000; R-20,000; S-7,500; T-15,000; U-2,500.

All marked forms were to go in relief of underwriters whose names they bear. Applications for

20,000 shares were received but not marked. The applications on forms marked by the

underwriters were P-12,500, Q-25,000 R-10,000 S-10,000, T-7500, U-Nil. Show the ultimate liability

of each underwriter in respect of his agreement in A Ltd.

[M. Com. Rohilkhand University]

Solution:

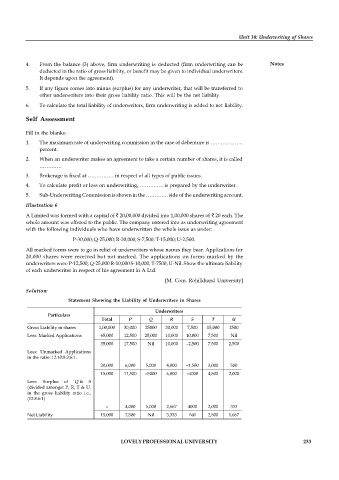

Statement Showing the Liability of Underwriters in Shares

Underwriters

Particulars

Total P Q R S T U

Gross Liability in shares 1,00,000 30,000 25000 20,000 7,500 15,000 2500

Less: Marked Applications 65,000 12,500 25,000 10,000 10,000 7,500 Nil

35,000 17,500 Nil 10,000 –2,500 7,500 2,500

Less: Unmarked Applications

in the ratio: 12:10:8:3:6:1.

20,000 6,000 5,000 4,000 –1,500 3,000 500

15,000 11,500 –5000 6,000 –4000 4,500 2,000

Less: Surplus of ‘Q’& S

(divided amongst P, R, T & U.

in the gross liability ratio i.e.,

(12:8:6:1)

– 4,000 5,000 2,667 4000 2,000 333

Net Liability 15,000 7,500 Nil 3,333 Nil 2,500 1,667

LOVELY PROFESSIONAL UNIVERSITY 233