Page 237 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 237

Accounting for Companies-I

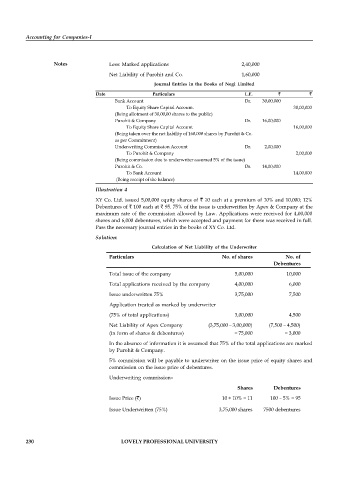

Notes Less: Marked applications 2,40,000

Net Liability of Purohit and Co. 1,60,000

Journal Entries in the Books of Negi Limited

Date Particulars L.F.

Bank Account Dr. 30,00,000

To Equity Share Capital Account. 30,00,000

(Being allotment of 30,00,00 shares to the public)

Purohit & Company Dr. 16,00,000

To Equity Share Capital Account 16,00,000

(Being taken over the net liability of 160,000 shares by Purohit & Co.

as per Commitment)

Underwriting Commission Account Dr. 2,00,000

To Purohit & Company 2,00,000

(Being commission due to underwriter assumed 5% of the issue)

Purohit & Co. Dr. 14,00,000

To Bank Account 14,00,000

(Being receipt of the balance)

Illustration 4

XY Co. Ltd. issued 5,00,000 equity shares of 10 each at a premium of 10% and 10,000; 12%

Debentures of 100 each at 95. 75% of the issue is underwritten by Apex & Company at the

maximum rate of the commission allowed by Law. Applications were received for 4,00,000

shares and 6,000 debentures, which were accepted and payment for these was received in full.

Pass the necessary journal entries in the books of XY Co. Ltd.

Solution:

Calculation of Net Liability of the Underwriter

Particulars No. of shares No. of

Debentures

Total issue of the company 5,00,000 10,000

Total applications received by the company 4,00,000 6,000

Issue underwritten 75% 3,75,000 7,500

Application treated as marked by underwriter

(75% of total applications) 3,00,000 4,500

Net Liability of Apex Company (3,75,000 – 3,00,000) (7,500 – 4,500)

(in form of shares & debentures) = 75,000 = 3,000

In the absence of information it is assumed that 75% of the total applications are marked

by Purohit & Company.

5% commission will be payable to underwriter on the issue price of equity shares and

commission on the issue price of debentures.

Underwriting commission–

Shares Debentures

Issue Price ( ) 10 + 10% = 11 100 – 5% = 95

Issue Underwritten (75%) 3,75,000 shares 7500 debentures

230 LOVELY PROFESSIONAL UNIVERSITY