Page 234 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 234

Unit 10: Underwriting of Shares

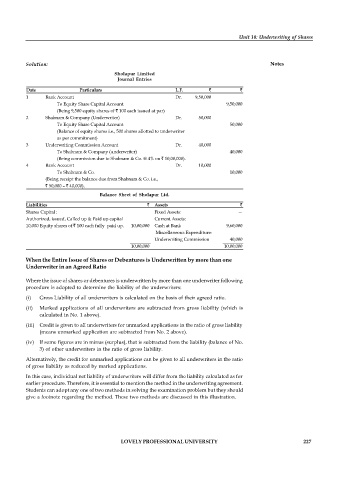

Solution: Notes

Sholapur Limited

Journal Entries

Date Particulars L.F.

1 Bank Account Dr. 9,50,000

To Equity Share Capital Account. 9,50,000

(Being 9,500 equity shares of 100 each issued at par)

2 Shabnam & Company (Underwriter) Dr. 50,000

To Equity Share Capital Account 50,000

(Balance of equity shares i.e., 500 shares allotted to underwriter

as per commitment)

3 Underwriting Commission Account Dr. 40,000

To Shabnam & Company (underwriter) 40,000

(Being commission due to Shabnam & Co. @ 4% on 10,00,000).

4 Bank Account Dr. 10,000

To Shabnam & Co. 10,000

(Being receipt the balance due from Shabnam & Co. i.e.,

50,000 – 40,000).

Balance Sheet of Sholapur Ltd.

Liabilities Assets

Shares Capital : Fixed Assets: —

Authorized, issued, Called up & Paid up capital Current Assets:

10,000 Equity shares of 100 each fully paid up. 10,00,000 Cash at Bank 9,60,000

Miscellaneous Expenditure:

Underwriting Commission 40,000

10,00,000 10,00,000

When the Entire Issue of Shares or Debentures is Underwritten by more than one

Underwriter in an Agreed Ratio

Where the issue of shares or debentures is underwritten by more than one underwriter following

procedure is adopted to determine the liability of the underwriters:

(i) Gross Liability of all underwriters is calculated on the basis of their agreed ratio.

(ii) Marked applications of all underwriters are subtracted from gross liability (which is

calculated in No. 1 above).

(iii) Credit is given to all underwriters for unmarked applications in the ratio of gross liability

(means unmarked application are subtracted from No. 2 above).

(iv) If some figures are in minus (surplus), that is subtracted from the liability (balance of No.

3) of other underwriters in the ratio of gross liability.

Alternatively, the credit for unmarked applications can be given to all underwriters in the ratio

of gross liability as reduced by marked applications.

In this case, individual net liability of underwriters will differ from the liability calculated as for

earlier procedure. Therefore, it is essential to mention the method in the underwriting agreement.

Students can adopt any one of two methods in solving the examination problem but they should

give a footnote regarding the method. These two methods are discussed in this illustration.

LOVELY PROFESSIONAL UNIVERSITY 227