Page 231 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 231

Accounting for Companies-I

Notes underwriters have agreed to underwrite and to take up, and the amount or rate of

commission should also be disclosed in the prospectus as per provision of Section 76 of the

Companies Act.

(ii) In Statutory Report: The extent to which each underwriting contract, if any, has not been

carried out and the reason therefore, should be stated. This is merely because the directors

at the time of issuing a prospectus give a declaration that in their opinion, the underwriters

have the resources to carry out their obligations.

(iii) In the Balance Sheet: As per the requirements of the Schedule VI of the Companies Act, all

underwriting commission or brokerage payable must be shown in the assets side of the

balance sheet under the heading ‘Miscellaneous Expenditure’.

Distinction between Underwriter and Broker

As discussed earlier, an underwriter is that individual who agrees to take over a certain number

of shares or debentures if the public does not subscribe to them. An amount for this consideration

payable to the underwriter is called underwriting commission. On the other hand, a broker is a

person who provides services in bringing a settlement between a seller and purchaser of the

shares or debentures for a reward which is called brokerage. A broker can also procure the

subscription to the shares or debentures from the public on the behalf of the company. Such a

broker can only procure the subscription and does not undertake the responsibility of subscribing

to the shares or debentures of the company. As per Section 76(3) of the Companies Act, a

company is permitted to pay a reasonable amount of brokerage in addition to the payment of

underwriting commission.

10.6 Rates of Underwriting Commission, Brokerage and

Remuneration to Managers

Following the SEBI guidelines, the following rates regarding the payment of underwriting

commission, brokerage and remuneration to manager to the issue were issued by the Ministry

of Finance on 7th May 1985:-

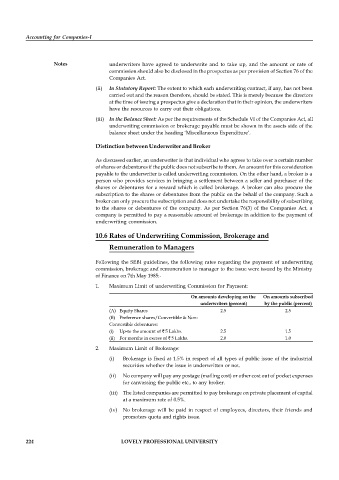

1. Maximum Limit of underwriting Commission for Payment:

On amounts developing on the On amounts subscribed

underwriters (percent) by the public (percent)

(A) Equity Shares 2.5 2.5

(B) Preference shares/Convertible & Non-

Convertible debentures:

(i) Up-to the amount of 5 Lakhs. 2.5 1.5

(ii) For months in excess of 5 Lakhs. 2.0 1.0

2. Maximum Limit of Brokerage:

(i) Brokerage is fixed at 1.5% in respect of all types of public issue of the industrial

securities whether the issue is underwritten or not.

(ii) No company will pay any postage (mailing cost) or other cost out of pocket expenses

for canvassing the public etc., to any broker.

(iii) The listed companies are permitted to pay brokerage on private placement of capital

at a maximum rate of 0.5%.

(iv) No brokerage will be paid in respect of employees, directors, their friends and

promoters quota and rights issue.

224 LOVELY PROFESSIONAL UNIVERSITY