Page 235 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 235

Accounting for Companies-I

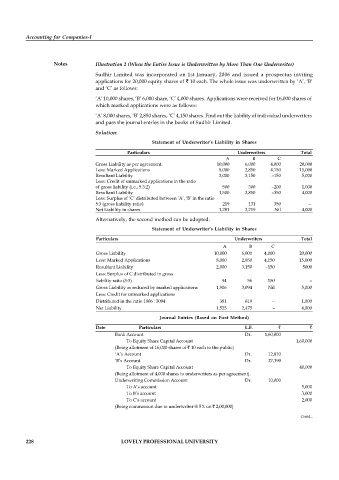

Notes Illustration 2 (When the Entire Issue is Underwritten by More Than One Underwriter)

Sudhir Limited was incorporated on 1st January, 2006 and issued a prospectus inviting

applications for 20,000 equity shares of 10 each. The whole issue was underwritten by ‘A’, ‘B’

and ‘C’ as follows:

‘A’ 10,000 shares, ‘B’ 6,000 share, ‘C’ 4,000 shares. Applications were received for 16,000 shares of

which marked applications were as follows:

‘A’ 8,000 shares, ‘B’ 2,850 shares, ‘C’ 4,150 shares. Find out the liability of individual underwriters

and pass the journal entries in the books of Sudhir Limited.

Solution:

Statement of Underwriter’s Liability in Shares

Particulars Underwriters Total

A B C

Gross Liability as per agreement. 10,000 6,000 4,000 20,000

Less: Marked Applications 8,000 2,850 4,150 15,000

Resultant Liability 2,000 3,150 –150 5,000

Less: Credit of unmarked applications in the ratio

of gross liability (i.e., 5:3:2) 500 300 –200 1,000

Resultant Liability 1,500 2,850 –350 4,000

Less: Surplus of ‘C’ distributed between ‘A’, ‘B’ in the ratio

5:3 (gross liability ratio) 219 131 350 —

Net Liability in shares 1,281 2,719 Nil 4,000

Alternatively, the second method can be adopted.

Statement of Underwriter’s Liability in Shares

Particulars Underwriters Total

A B C

Gross Liability 10,000 6,000 4,000 20,000

Less: Marked Applications 8,000 2,850 4,150 15,000

Resultant Liability 2,000 3,150 –150 5000

Less: Surplus of C distributed in gross

liability ratio (5:3) 94 56 150 –

Gross Liability as reduced by marked applications 1,906 3,094 Nil 5,000

Less: Credit for unmarked applications

Distributed in the ratio 1906 : 3094 381 619 – 1,000

Net Liability 1,525 2,475 – 4,000

Journal Entries (Based on First Method)

Date Particulars L.F.

Bank Account Dr. 1,60,000

To Equity Share Capital Account 1,60,000

(Being allotment of 16,000 shares of 10 each to the public)

‘A’s Account Dr. 12,810

‘B’s Account Dr. 27,190

To Equity Share Capital Account 40,000

(Being allotment of 4,000 shares to underwriters as per agreement).

Underwriting Commission Account Dr. 10,000

To A’s account 5,000

To B’s account 3,000

To C’s account 2,000

(Being commission due to underwriter @ 5% on 2,00,000)

Bank Account Dr. 32,000

Contd...

To A’s Account 7,810

To B’s Account 24,190

(Being receipt of the balance from A & B)

C’s Account Dr. 2,000

228 LOVELY PROFESSIONAL UNIVERSITY

To Bank Account 2,000

(Being payment of commission to C)