Page 236 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 236

Particulars

Dr.

To Equity Share Capital Account

(Being allotment of 16,000 shares of 10 each to the public)

Dr.

‘A’s Account

12,810

Date Bank Account L.F. 1,60,000 1,60,000

‘B’s Account Dr. 27,190

To Equity Share Capital Account 40,000

(Being allotment of 4,000 shares to underwriters as per agreement).

Underwriting Commission Account Dr. 10,000

Unit 10: Underwriting of Shares

To A’s account 5,000

To B’s account 3,000

To C’s account 2,000

(Being commission due to underwriter @ 5% on 2,00,000)

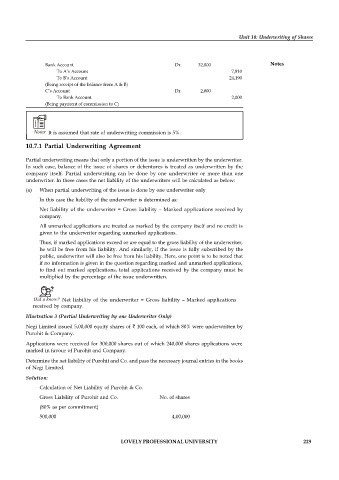

Bank Account Dr. 32,000 Notes

To A’s Account 7,810

To B’s Account 24,190

(Being receipt of the balance from A & B)

C’s Account Dr. 2,000

To Bank Account 2,000

(Being payment of commission to C)

Notes It is assumed that rate of underwriting commission is 5%.

10.7.1 Partial Underwriting Agreement

Partial underwriting means that only a portion of the issue is underwritten by the underwriter.

In such case, balance of the issue of shares or debentures is treated as underwritten by the

company itself. Partial underwriting can be done by one underwriter or more than one

underwriter. In these cases the net liability of the underwriters will be calculated as below:

(a) When partial underwriting of the issue is done by one underwriter only

In this case the liability of the underwriter is determined as:

Net liability of the underwriter = Gross liability – Marked applications received by

company.

All unmarked applications are treated as marked by the company itself and no credit is

given to the underwriter regarding unmarked applications.

Thus, if marked applications exceed or are equal to the gross liability of the underwriter,

he will be free from his liability. And similarly, if the issue is fully subscribed by the

public, underwriter will also be free from his liability. Here, one point is to be noted that

if no information is given in the question regarding marked and unmarked applications,

to find out marked applications, total applications received by the company must be

multiplied by the percentage of the issue underwritten.

Did u know? Net liability of the underwriter = Gross liability – Marked applications

received by company.

Illustration 3 (Partial Underwriting by one Underwriter Only)

Negi Limited issued 5,00,000 equity shares of 100 each, of which 80% were underwritten by

Purohit & Company.

Applications were received for 300,000 shares out of which 240,000 shares applications were

marked in favour of Purohit and Company.

Determine the net liability of Purohit and Co. and pass the necessary journal entries in the books

of Negi Limited.

Solution:

Calculation of Net Liability of Purohit & Co.

Gross Liability of Purohit and Co. No. of shares

(80% as per commitment)

500,000 4,00,000

LOVELY PROFESSIONAL UNIVERSITY 229