Page 323 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 323

Accounting for Companies-I

Notes notification of the Government of India, in the Ministry of Industrial Development and Company

Affairs (Department of Company Affairs) G.S.R. No. 129, dated the 3rd day of January, 1968 any

balance sheet in relation to which the paragraph applies has already been made in the first

balance sheet made out and laid before the company in its annual general meeting, the adjustment

referred to in this paragraph may be made out after the issue of the said notification.

Explanation 2: In this paragraph unless the context otherwise requires, the expression “rate of

exchange”, “Foreign currency” and “Indian currency” shall have the meanings respectively

assigned to them under sub-section (1) of Section 43A of the Income Tax Act (XLII of 1961) and

Explanation 2 and Explanation 3 of the said sub-section shall as far as may apply in relation to

the said paragraph, as they apply to the said sub-section (1).

Did u know? Except in the case of the first balance sheet laid before the company after the

commencement of the Act, the corresponding amounts of the immediately preceding financial

year for all items shown in the balance sheet shall be also given in the balance sheet.

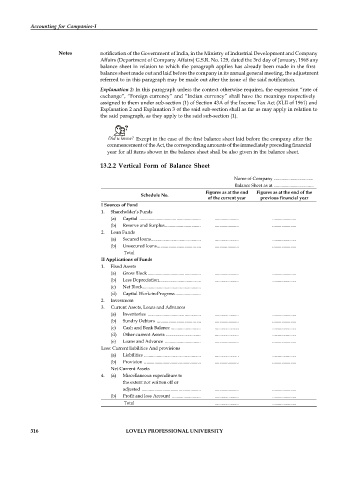

13.2.2 Vertical Form of Balance Sheet

Name of Company ...................................

Balance Sheet as at ...................................

Figures as at the end Figures as at the end of the

Schedule No.

of the current year previous financial year

I Sources of Fund

1. Shareholder’s Funds

(a) Capital ..................................................... ..................... .....................

(b) Reserve and Surplus............................... ..................... .....................

2. Loan Funds

(a) Secured loans........................................... ..................... .....................

(b) Unsecured loans...................................... ..................... .....................

Total

II Applications of Funds

1. Fixed Assets

(a) Gross Block .............................................. ..................... .....................

(b) Less Depreciation.................................... ..................... .....................

(c) Net Block..................................................

(d) Capital Work-in-Progress ......................

2. Investment

3. Current Assets, Loans and Advances

(a) Inventories .............................................. ..................... .....................

(b) Sundry Debtors ...................................... ..................... .....................

(c) Cash and Bank Balance .......................... ..................... .....................

(d) Other current Assets .............................. ..................... .....................

(e) Loans and Advance ............................... ..................... .....................

Less: Current liabilities And provisions

(a) Liabilities ................................................. ..................... .....................

(b) Provision ................................................. ..................... .....................

Net Current Assets

4. (a) Miscellaneous expenditure to

the extent not written off or

adjusted ................................................... ..................... .....................

(b) Profit and loss Account ......................... ..................... .....................

Total ..................... .....................

316 LOVELY PROFESSIONAL UNIVERSITY