Page 328 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 328

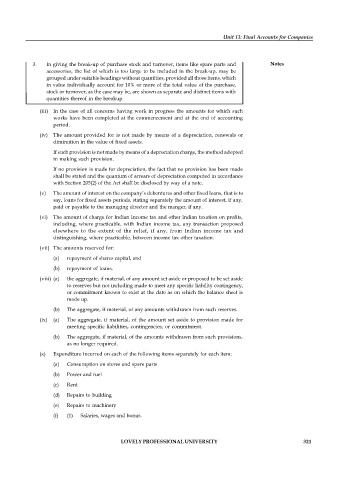

Unit 13: Final Accounts for Companies

3. In giving the break-up of purchase stock and turnover, items like spare parts and Notes

accessories, the list of which is too large to be included in the break-up, may be

grouped under suitable headings without quantities, provided all those items, which

in value individually account for 10% or more of the total value of the purchase,

stock or turnover, as the case may be, are shown as separate and distinct items with

quantities thereof in the breakup.

(iii) In the case of all concerns having work in progress the amounts for which such

works have been completed at the commencement and at the end of accounting

period.

(iv) The amount provided for is not made by means of a depreciation, renewals or

diminution in the value of fixed assets.

If such provision is not made by means of a depreciation charge, the method adopted

in making such provision.

If no provision is made for depreciation, the fact that no provision has been made

shall be stated and the quantum of arrears of depreciation computed in accordance

with Section 205(2) of the Act shall be disclosed by way of a note.

(v) The amount of interest on the company’s debentures and other fixed loans, that is to

say, loans for fixed assets periods, stating separately the amount of interest, if any,

paid or payable to the managing director and the manger, if any.

(vi) The amount of charge for Indian Income tax and other Indian taxation on profits,

including, where practicable, with Indian income tax, any transaction proposed

elsewhere to the extent of the relief, if any, from Indian income tax and

distinguishing, where practicable, between income tax other taxation.

(vii) The amounts reserved for:

(a) repayment of shares capital, and

(b) repayment of loans.

(viii) (a) the aggregate, if material, of any amount set aside or proposed to be set aside

to reserves but not including made to meet any specific liability contingency,

or commitment known to exist at the date as on which the balance sheet is

made up.

(b) The aggregate, if material, of any amounts withdrawn from such reserves.

(ix) (a) The aggregate, if material, of the amount set aside to provision made for

meeting specific liabilities, contingencies, or commitment.

(b) The aggregate, if material, of the amounts withdrawn from such provisions,

as no longer required.

(x) Expenditure incurred on each of the following items separately for each item:

(a) Consumption on stores and spare parts

(b) Power and fuel

(c) Rent

(d) Repairs to building

(e) Repairs to machinery

(f) (1) Salaries, wages and bonus.

LOVELY PROFESSIONAL UNIVERSITY 321