Page 34 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 34

Unit 1: Share Capital – Issue of Shares

(iii) allot in full to other applicants Notes

(iv) utilise excess application money in part payment of allotment.

All the moneys due on allotment and final calls were duly received. Make necessary journal

entries in the books of company.

Solution:

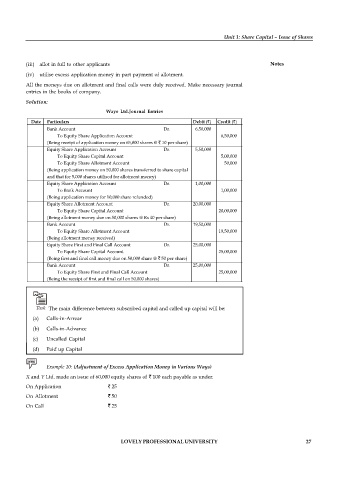

Waye Ltd.Journal Entries

Date Particulars Debit ( ) Credit ( )

Bank Account Dr. 6,50,000

To Equity Share Application Account 6,50,000

(Being receipt of application money on 65,000 shares @ 10 per share)

Equity Share Application Account Dr. 5,50,000

To Equity Share Capital Account 5,00,000

To Equity Share Allotment Account 50,000

(Being application money on 50,000 shares transferred to share capital

and that for 5,000 shares utilised for allotment money)

Equity Share Application Account Dr. 1,00,000

To Bank Account 1,00,000

(Being application money for 10,000 share refunded)

Equity Share Allotment Account Dr. 20,00,000

To Equity Share Capital Account 20,00,000

(Being allotment money due on 50,000 shares @ Rs 40 per share)

Bank Account Dr. 19,50,000

To Equity Share Allotment Account 19,50,000

(Being allotment money received)

Equity Share First and Final Call Account Dr. 25,00,000

To Equity Share Capital Account 25,00,000

(Being first and final call money due on 50,000 share @ 50 per share)

Bank Account Dr. 25,00,000

To Equity Share First and Final Call Account 25,00,000

(Being the receipt of first and final call on 50,000 shares)

Task The main difference between subscribed capital and called up capital will be:

(a) Calls-in-Arrear

(b) Calls-in-Advance

(c) Uncalled Capital

(d) Paid up Capital

Example 10: (Adjustment of Excess Application Money in Various Ways)

X and Y Ltd. made an issue of 60,000 equity shares of 100 each payable as under:

On Application 25

On Allotment 50

On Call 25

LOVELY PROFESSIONAL UNIVERSITY 27