Page 40 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 40

Unit 1: Share Capital – Issue of Shares

Notes

= = 4,500 shares

Amount of share capital = 4500 ´ 100 = 450,000

Amount of share premium – 4,5000 ´ 20 = 90,000

Purchase Price

(ii) No of shares issued at a discount of 10% =

Issue price of one share

= = 6,000 shares

Amount of share capital = 6000 ´ 100 = 6,00,000

Amount of discount on shares = 6000 ´ 10 = 60,000

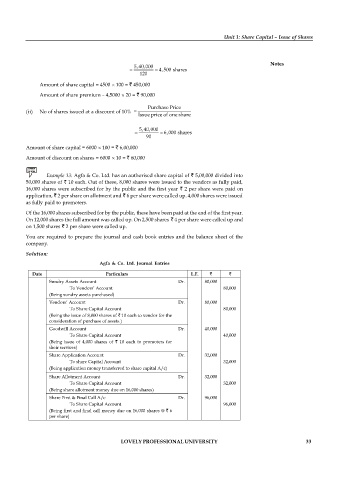

Example 13: Agfa & Co. Ltd. has an authorised share capital of 5,00,000 divided into

50,000 shares of 10 each. Out of these, 8,000 shares were issued to the vendors as fully paid,

16,000 shares were subscribed for by the public and the first year 2 per share were paid on

application, 2 per share on allotment and 6 per share were called up. 4,000 shares were issued

as fully paid to promoters.

Of the 16,000 shares subscribed for by the public, these have been paid at the end of the first year.

On 12,000 shares the full amount was called up. On 2,500 shares 4 per share were called up and

on 1,500 shares 2 per share were called up.

You are required to prepare the journal and cash book entries and the balance sheet of the

company.

Solution:

Agfa & Co. Ltd. Journal Entries

Date Particulars L.F.

Sundry Assets Account Dr. 80,000

To Vendors’ Account 80,000

(Being sundry assets purchased)

Vendors’ Account Dr. 80,000

To Share Capital Account 80,000

(Being the issue of 8,000 shares of 10 each to vendor for the

consideration of purchase of assets.)

Goodwill Account Dr. 40,000

To Share Capital Account 40,000

(Being issue of 4,000 shares of 10 each to promoters for

their services)

Share Application Account Dr. 32,000

To share Capital Account 32,000

(Being application money transferred to share capital A/c)

Share Allotment Account Dr. 32,000

To Share Capital Account 32,000

(Being share allotment money due on 16,000 shares)

Share First & Final Call A/c Dr. 96,000

To Share Capital Account 96,000

(Being first and final call money due on 16,000 shares @ 6

per share)

LOVELY PROFESSIONAL UNIVERSITY 33