Page 163 - DCOM202_COST_ACCOUNTING_I

P. 163

Unit 8: Overheads

8.1 Meaning and Definition of Overhead Notes

Meaning of overhead: The term has overhead has a wider meaning than the term indirect

expenses. Overhead includes the cost of indirect material, indirect labour, and indirect expense.

This is the aggregate sum of indirect material, indirect labour and indirect expense.

Overhead = Indirect material + indirect labour + indirect expenses

Definition of overheads: The indirect costs or fixed expenses of operating a business (that is, the

costs not directly related to the manufacture of a product or delivery of a service) that range from

rent to administrative costs to marketing costs.

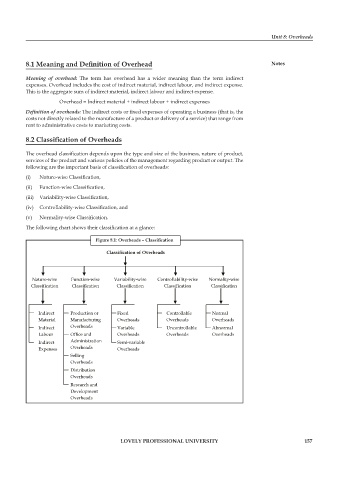

8.2 Classification of Overheads

The overhead classification depends upon the type and size of the business, nature of product,

services of the product and various policies of the management regarding product or output. The

following are the important basis of classification of overheads:

(i) Nature-wise Classification,

(ii) Function-wise Classification,

(iii) Variability-wise Classification,

(iv) Controllability-wise Classification, and

(v) Normality-wise Classification.

The following chart shows their classification at a glance:

Figure 8.1: Overheads – Classification

Classification of Overheads

Nature-wise Function-wise Variability-wise Controllability-wise Normality-wise

Classification Classification Classification Classification Classification

Indirect Production or Fixed Controllable Normal

Material Manufacturing Overheads Overheads Overheads

Indirect Overheads Variable Uncontrollable Abnormal

Labour Office and Overheads Overheads Overheads

Indirect Administration Semi-variable

Expenses Overheads Overheads

Selling

Overheads

Distribution

Overheads

Research and

Development

Overheads

LOVELY PROFESSIONAL UNIVERSITY 157