Page 164 - DCOM202_COST_ACCOUNTING_I

P. 164

Cost Accounting – I

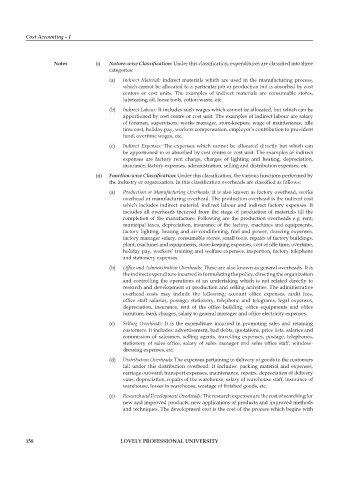

Notes (i) Nature-wise Classification: Under this classification, expenditures are classified into three

categories:

(a) Indirect Material: Indirect materials which are used in the manufacturing process,

which cannot be allocated to a particular job or production but is absorbed by cost

centers or cost units. The examples of indirect materials are consumable stores,

lubricating oil, loose tools, cotton waste, etc.

(b) Indirect Labour: It includes such wages which cannot be allocated, but which can be

apportioned by cost centre or cost unit. The examples of indirect labour are salary

of foremen, supervisors, works manager, store-keepers, wage of maintenance, idle

time cost, holiday pay, workers compensation, employer’s contribution to provident

fund, overtime wages, etc.

(c) Indirect Expenses: The expenses which cannot be allocated directly but which can

be apportioned to or absorbed by cost centre or cost unit. The examples of indirect

expenses are factory rent charge, charges of lighting and heating, depreciation,

insurance, factory expenses, administration, selling and distribution expenses, etc.

(ii) Function-wise Classification: Under this classification, the various functions performed by

the industry or organization. In this classification overheads are classified as follows:

(a) Production or Manufacturing Overheads: It is also known as factory overhead, works

overhead or manufacturing overhead. The production overhead is the indirect cost

which includes indirect material, indirect labour and indirect factory expenses. It

includes all overheads incurred from the stage of production of materials till the

completion of the manufacture. Following are the production overheads e.g. rent,

municipal taxes, depreciation, insurance of the factory, machines and equipments,

factory lighting, heating and air-conditioning, fuel and power, drawing expenses,

factory manager salary, consumable stores, small tools, repairs of factory buildings,

plant, machines and equipments, store-keeping expenses, cost of idle time, overtime,

holiday pay, workers’ training and welfare expenses, inspection, factory telephone

and stationery expenses.

(b) Office and Administration Overheads: These are also known as general overheads. It is

the indirect expenditure incurred in formulating the policy, directing the organization

and controlling the operations of an undertaking which is not related directly to

research and development or production and selling activities. The administrative

overhead costs may include the following: account office expenses, audit fees,

office staff salaries, postage, stationery, telephone and telegrams, legal expenses,

depreciation, insurance, rent of the office building, office equipments and office

furniture, bank charges, salary to general manager and office electricity expenses.

(c) Selling Overheads: It is the expenditure incurred in promoting sales and retaining

customers. It includes: advertisement, bad debts, quotations, price lists, salaries and

commission of salesmen, selling agents, travelling expenses, postage, telephones,

stationery of sales office, salary of sales manager and sales office staff, window-

dressing expenses, etc.

(d) Distribution Overheads: The expenses pertaining to delivery of goods to the customers

fall under this distribution overhead. It includes: packing material and expenses,

carriage outward, transport expenses, maintenance, repairs, depreciation of delivery

vans, depreciation, repairs of the warehouse, salary of warehouse staff, insurance of

warehouse, losses in warehouse, wastage of finished goods, etc.

(e) Research and Development Overheads: The research expenses are the cost of searching for

new and improved products, new applications of products and improved methods

and techniques. The development cost is the cost of the process which begins with

158 LOVELY PROFESSIONAL UNIVERSITY