Page 223 - DCOM202_COST_ACCOUNTING_I

P. 223

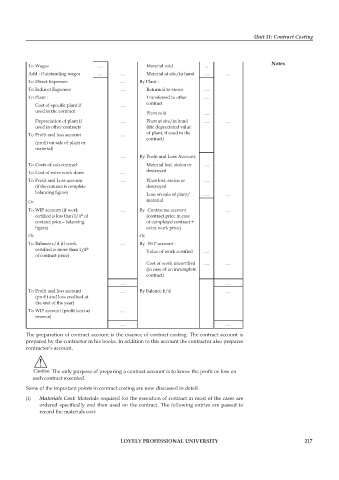

Unit 11: Contract Costing

Notes

To Wages .... Material sold ...

Add : Outstanding wages .... .... Material at site/in hand .... ....

To Direct Expenses .... By plant :

To Indirect Expenses .... Returned to stores ....

To plant : Transferred to other ....

Cost of specific plant if .... contract

used in the contract plant sold ....

Depreciation of plant if .... plant at site/in hand .... ....

used in other contracts (the depreciated value

To Profit and loss account .... of plant, if used in the

contract)

(profit on sale of plant or

material)

.... By Profit and Loss Account:

To Costs of sub-contract Material lost, stolen or ....

To Cost of extra work done .... destroyed

To Profit and Loss account .... plant lost, stolen or ....

(if the contract is complete destroyed

balancing figure) Loss on sale of plant/ .... ....

Or material

To WIP account (if work .... By Contractee account ....

certified is less than 1/4 of (contract price in case

th

contract price – balancing of completed contract +

figure) extra work price)

Or Or

To Balance c/d (if work .... By WIp account :

certified is more than 1/4 Value of work certified ....

th

of contract price)

Cost of work uncertified .... ....

(in case of an incomplete

contract)

.... ....

To Profit and loss account .... By Balance b/d ....

(profit and loss credited at

the end of the year)

To WIP account (profit kept as ....

reserve)

.... ....

The preparation of contract account is the essence of contract costing. The contract account is

prepared by the contractor in his books. In addition to this account the contractor also prepares

contractee’s account.

!

Caution The only purpose of preparing a contract account is to know the profit or loss on

each contract executed.

Some of the important points in contract costing are now discussed in detail.

(i) Materials Cost: Materials required for the execution of contract in most of the cases are

ordered specifically and then used on the contract. The following entries are passed to

record the materials cost:

LOVELY PROFESSIONAL UNIVERSITY 217