Page 28 - DCOM202_COST_ACCOUNTING_I

P. 28

Cost Accounting – I

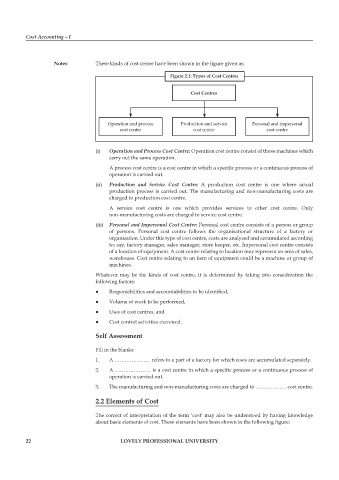

Notes These kinds of cost centre have been shown in the figure given as:

Figure 2.1: Types of Cost Centres

Cost Centres

Operation and process production and service personal and impersonal

cost centre cost centre cost centre

(i) Operation and Process Cost Centre: Operation cost centre consist of those machines which

carry out the same operation.

A process cost centre is a cost centre in which a specific process or a continuous process of

operation is carried out.

(ii) Production and Service Cost Centre: A production cost centre is one where actual

production process is carried out. The manufacturing and non-manufacturing costs are

charged to production cost centre.

A service cost centre is one which provides services to other cost centre. Only

non-manufacturing costs are charged to service cost centre.

(iii) Personal and Impersonal Cost Centre: personal cost centre consists of a person or group

of persons. personal cost centre follows the organisational structure of a factory or

organisation. Under this type of cost centre, costs are analysed and accumulated according

to; say, factory manager, sales manager, store keeper, etc. Impersonal cost centre consists

of a location of equipment. A cost centre relating to location may represent an area of sales,

warehouse. Cost centre relating to an item of equipment could be a machine or group of

machines.

Whatever may be the kinds of cost centre, it is determined by taking into consideration the

following factors:

z z Responsibilities and accountabilities to be identified,

z z Volume of work to be performed,

z z Uses of cost centres, and

z z Cost control activities exercised.

Self Assessment

Fill in the blanks:

1. A ………………… refers to a part of a factory for which costs are accumulated separately.

2. A ………………… is a cost centre in which a specific process or a continuous process of

operation is carried out.

3. The manufacturing and non-manufacturing costs are charged to ……………… cost centre.

2.2 Elements of Cost

The correct of interpretation of the term ‘cost’ may also be understood by having knowledge

about basic elements of cost. These elements have been shown in the following figure:

22 LOVELY PROFESSIONAL UNIVERSITY