Page 208 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 208

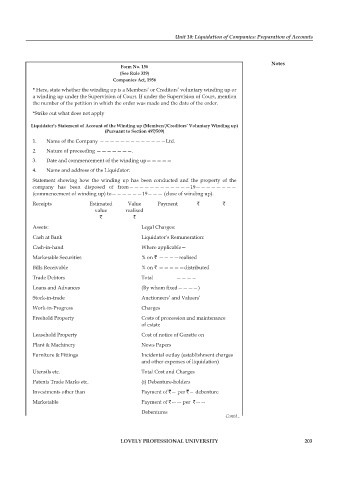

Unit 10: Liquidation of Companies: Preparation of Accounts

notes

form no. 156

(see rule 329)

companies act, 1956

* Here, state whether the winding up is a Members’ or Creditors’ voluntary winding up or

a winding up under the Supervision of Court. If under the Supervision of Court, mention

the number of the petition in which the order was made and the date of the order.

*Strike out what does not apply

liquidator’s statement of account of the Winding up (members’/creditors’ voluntary Winding up)

(pursuant to section 497/509)

1. Name of the Company —————————————Ltd.

2. Nature of proceeding ———————.

3. Date and commencement of the winding up—————

4. Name and address of the Liquidator:

Statement showing how the winding up has been conducted and the property of the

company has been disposed of from————————————19————————

(commencement of winding up) to——————19——— (close of winding up).

Receipts Estimated Value Payment ` `

value realised

` `

Assets: Legal Charges:

Cash at Bank Liquidator’s Remuneration:

Cash-in-hand Where applicable—

Marketable Securities % on ` ————realised

Bills Receivable % on ` —————distributed

Trade Debtors Total ————

Loans and Advances (By whom fixed————)

Stock-in-trade Auctioneers’ and Valuers’

Work-in-Progress Charges

Freehold Property Costs of procession and maintenance

of estate

Leasehold Property Cost of notice of Gazette on

Plant & Machinery News Papers

Furniture & Fittings Incidental outlay (establishment charges

and other expenses of liquidation)

Utensils etc. Total Cost and Charges

Patents Trade Marks etc. (i) Debenture-holders

Investments other than Payment of `— per `— debenture

Marketable Payment of `—— per `——

Debentures

Contd...

lovely professional university 203