Page 211 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 211

Accounting for Companies – II

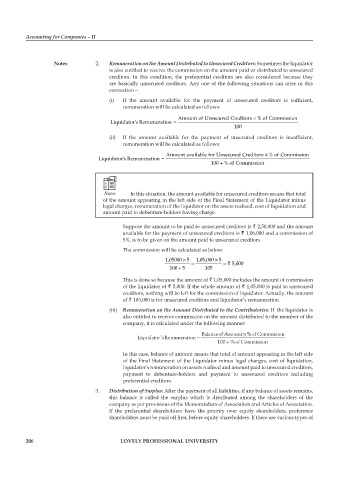

notes 2. Remuneration on the Amount Distributed to Unsecured Creditors: Sometimes the liquidator

is also entitled to receive the commission on the amount paid or distributed to unsecured

creditors. In this condition, the preferential creditors are also considered because they

are basically unsecured creditors. Any one of the following situations can arise in this

connection—

(i) If the amount available for the payment of unsecured creditors is sufficient,

remuneration will be calculated as follows:

Amount of Unsecured Creditors × % of Commission

Liquidator's Remuneration =

100

(ii) If the amount available for the payment of unsecured creditors is insufficient,

remuneration will be calculated as follows:

Amount available for Unsecured Creditors × % of Commission

Liquidator's Remuneration =

100 + % of Commission

Notes In this situation, the amount available for unsecured creditors means that total

of the amount appearing in the left side of the Final Statement of the Liquidator minus

legal charges, remuneration of the liquidator on the assets realised, cost of liquidation and

amount paid to debenture-holders having charge.

Suppose the amount to be paid to unsecured creditors is ` 2,50,000 and the amount

available for the payment of unsecured creditors is ` 1,06,000 and a commission of

5%, is to be given on the amount paid to unsecured creditors.

The commission will be calculated as below:

1,05000 5 = 1,05,000 5 = 5,000

×

×

100 5 105 `

+

This is done so because the amount of ` 1,05,000 includes the amount of commission

of the liquidator of ` 5,000. If the whole amount of ` 1,05,000 is paid to unsecured

creditors, nothing will be left for the commission of liquidator. Actually, the amount

of ` 105,000 is for unsecured creditors and liquidator’s remuneration.

(iii) Remuneration on the Amount Distributed to the Contributories: If the liquidator is

also entitled to receive commission on the amount distributed to the member of the

company, it is calculated under the following manner:

Liquidator'sRemuneration − Balanceof Amount ×%of Commission

100 + %of Commission

In this case, balance of amount means that total of amount appearing in the left side

of the Final Statement of the Liquidator minus legal charges, cost of liquidation,

liquidator’s remuneration on assets realised and amount paid to unsecured creditors,

payment to debenture-holders and payment to unsecured creditors including

preferential creditors.

3. Distribution of Surplus: After the payment of all liabilities, if any balance of assets remains,

this balance is called the surplus which is distributed among the shareholders of the

company as per provisions of the Memorandum of Association and Articles of Association.

If the preferential shareholders have the priority over equity shareholders, preference

shareholders must be paid off first, before equity shareholders. If there are various types of

206 lovely professional university