Page 215 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 215

Accounting for Companies – II

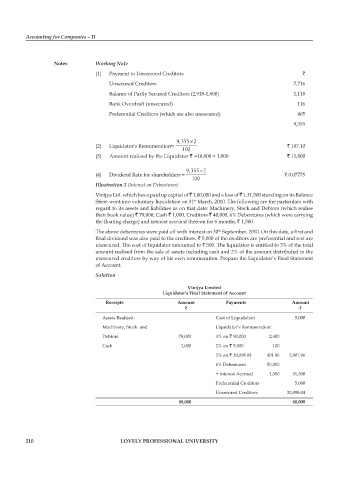

notes Working Note

(1) Payment to Unsecured Creditors `

Unsecured Creditors 7,716

Balance of Partly Secured Creditors (2,918-1,800) 1,118

Bank Overdraft (unsecured) 116

Preferential Creditors (which are also unsecured) 405

9,355

9,355 ×2

(2) Liquidator’s Remuneration= ` 187.10

100

(3) Amount realised by the Liquidator ` =10,000 + 1,800 ` 11,800

9,355 ×2

(4) Dividend Rate for shareholders = ` 0.07775

100

Illustration 3 (Interest on Debentures)

Vinijya Ltd. which has a paid up capital of ` 1,00,000 and a loss of ` 1,11,500 standing on its Balance

Sheet went into voluntary liquidation on 31 March, 2010. The following are the particulars with

st

regard to its assets and liabilities as on that date: Machinery, Stock and Debtors (which realise

their book value) ` 79,000; Cash ` 1,000, Creditors ` 40,000, 6% Debentures (which were carrying

the floating charge) and interest accrued thereon for 6 months ` 1,500.

The above debentures were paid off with interest on 30 September, 2010. On this date, a first and

th

final dividend was also paid to the creditors. ` 5,000 of the creditors are preferential and rest are

unsecured. The cost of liquidator amounted to ` 500. The liquidator is entitled to 3% of the total

amount realised from the sale of assets including cash and 2% of the amount distributed to the

unsecured creditors by way of his own remuneration. Prepare the Liquidator’s Final Statement

of Account.

Solution

vinijya limited

liquidator’s final statement of account

receipts amount payments amount

` `

Assets Realised: Cost of Liquidation 5,000

Machinery, Stock and Liquidator’s Remuneration:

Debtors 79,000 3% on ` 80,000 2,400

Cash 1,000 2% on ` 5,000 100

2% on ` 20,098.04 401.96 2,901.96

6% Debentures 50,000

+ Interest Accrued 1,500 51,500

Preferential Creditors 5,000

Unsecured Creditors 20,098.04

80,000 80,000

210 lovely professional university