Page 216 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 216

Unit 10: Liquidation of Companies: Preparation of Accounts

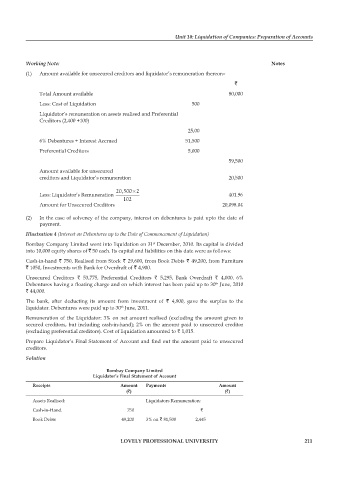

Working Note: notes

(1) Amount available for unsecured creditors and liquidator’s remuneration thereon–

`

Total Amount available 80,000

Less: Cost of Liquidation 500

Liquidator’s remuneration on assets realised and Preferential

Creditors (2,400 +100)

25,00

6% Debentures + Interest Accrued 51,500

Preferential Creditors 5,000

59,500

Amount available for unsecured

creditors and Liquidator’s remuneration 20,500

20,500 ×2

Less: Liquidator’s Remuneration 401.96

102

Amount for Unsecured Creditors 20,098.04

(2) In the case of solvency of the company, interest on debentures is paid upto the date of

payment.

Illustration 4 (Interest on Debentures up to the Date of Commencement of Liquidation)

Bombay Company Limited went into liquidation on 31 December, 2010. Its capital is divided

st

into 10,000 equity shares of ` 50 each. Its capital and liabilities on this date were as follows:

Cash-in-hand ` 750, Realised from Stock ` 29,600, from Book Debts ` 49,200, from Furniture

` 1050, Investments with Bank for Overdraft of ` 4,900.

Unsecured Creditors ` 53,775, Preferential Creditors ` 5,295, Bank Overdraft ` 4,000. 6%

th

Debentures having a floating charge and on which interest has been paid up to 30 June, 2010

` 44,000.

The bank, after deducting its amount from investment of ` 4,900, gave the surplus to the

liquidator. Debentures were paid up to 30 June, 2011.

th

Remuneration of the Liquidator: 3% on net amount realised (excluding the amount given to

secured creditors, but including cash-in-hand); 2% on the amount paid to unsecured creditor

(excluding preferential creditors). Cost of liquidation amounted to ` 1,015.

Prepare Liquidator’s Final Statement of Account and find out the amount paid to unsecured

creditors.

Solution

Bombay company limited

liquidator’s final statement of account

receipts amount payments amount

(`) (`)

Assets Realised: Liquidators Remuneration:

Cash-in-Hand. 750 `

Book Debts 49,200 3% on ` 81,500 2,445

lovely professional university 211