Page 214 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 214

Unit 10: Liquidation of Companies: Preparation of Accounts

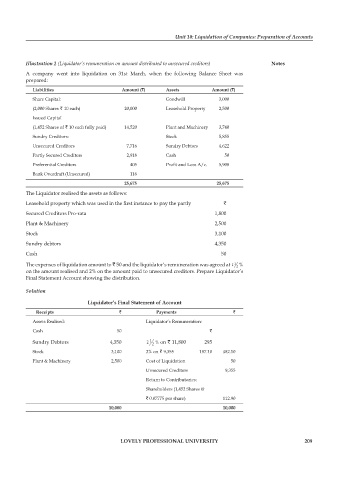

Illustration 2 (Liquidator’s remuneration on amount distributed to unsecured creditors) notes

A company went into liquidation on 31st March, when the following Balance Sheet was

prepared:

liabilities amount (`) assets amount (`)

Share Capital: Goodwill 3,000

(2,000 Shares ` 10 each) 20,000 Leasehold Property 2,500

Issued Capital

(1,452 Shares of ` 10 each fully paid) 14,520 Plant and Machinery 3,740

Sundry Creditors: Stock 5,855

Unsecured Creditors 7,716 Sundry Debtors 4,622

Partly Secured Creditors 2,918 Cash 50

Preferential Creditors 405 Profit and Loss A/c. 5,908

Bank Overdraft (Unsecured) 116

25,675 25,675

The Liquidator realised the assets as follows:

Leasehold property which was used in the first instance to pay the partly `

Secured Creditors Pro-rata 1,800

Plant & Machinery 2,500

Stock 3,100

Sundry debtors 4,350

Cash 50

The expenses of liquidation amount to ` 50 and the liquidator’s remuneration was agreed at 2 1 2 %

on the amount realised and 2% on the amount paid to unsecured creditors. Prepare Liquidator’s

Final Statement Account showing the distribution.

Solution

liquidator’s final statement of account

receipts ` payments `

Assets Realised: Liquidator’s Remuneration:

Cash 50 `

Sundry Debtors 4,350 2 1 2 % on ` 11,800 295

Stock 3,100 2% on ` 9,355 187.10 482.10

Plant & Machinery 2,500 Cost of Liquidation 50

Unsecured Creditors 9,355

Return to Contributories:

Shareholders (1,452 Shares @

` 0.07775 per share) 112.90

10,000 10,000

lovely professional university 209