Page 213 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 213

Accounting for Companies – II

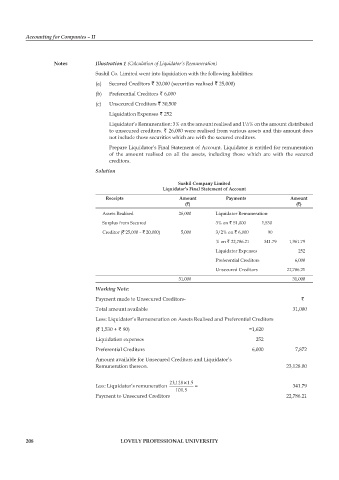

notes Illustration 1 (Calculation of Liquidator’s Remuneration)

Sushil Co. Limited went into liquidation with the following liabilities:

(a) Secured Creditors ` 20,000 (securities realised ` 25,000)

(b) Preferential Creditors ` 6,000

(c) Unsecured Creditors ` 30,500

Liquidation Expenses ` 252

Liquidator’s Remuneration: 3% on the amount realised and 1½% on the amount distributed

to unsecured creditors. ` 26,000 were realised from various assets and this amount does

not include those securities which are with the secured creditors.

Prepare Liquidator’s Final Statement of Account. Liquidator is entitled for remuneration

of the amount realised on all the assets, including those which are with the secured

creditors.

Solution

sushil company limited

liquidator’s final statement of account

receipts amount payments amount

(`) (`)

Assets Realised 26,000 Liquidator Remuneration:

Surplus from Secured 3% on ` 51,000 1,530

Creditor (` 25,000 – ` 20,000) 5,000 3/2% on ` 6,000 90

% on ` 22,786.21 341.79 1,961.79

Liquidator Expenses 252

Preferential Creditors 6,000

Unsecured Creditors 22,786.21

31,000 31,000

Working Note:

Payment made to Unsecured Creditors- `

Total amount available 31,000

Less: Liquidator’s Remuneration on Assets Realised and Preferential Creditors

(` 1,530 + ` 90) =1,620

Liquidation expenses 252

Preferential Creditors 6,000 7,872

Amount available for Unsecured Creditors and Liquidator’s

Remuneration thereon. 23,128.00

Less: Liquidator’s remuneration 23,128 ×1.5 = 341.79

101.5

Payment to Unsecured Creditors 22,786.21

208 lovely professional university