Page 218 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 218

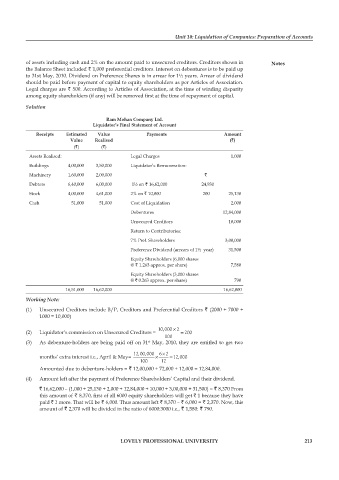

Unit 10: Liquidation of Companies: Preparation of Accounts

of assets including cash and 2% on the amount paid to unsecured creditors. Creditors shown in notes

the Balance Sheet included ` 1,000 preferential creditors. Interest on debentures is to be paid up

to 31st May, 2010. Dividend on Preference Shares is in arrear for 1½ years. Arrear of dividend

should be paid before payment of capital to equity shareholders as per Articles of Association.

Legal charges are ` 500. According to Articles of Association, at the time of winding disparity

among equity shareholders (if any) will be removed first at the time of repayment of capital.

Solution

ram mohan company ltd.

liquidator’s final statement of account

receipts estimated value payments amount

value realised (`)

(`) (`)

Assets Realised: Legal Charges 1,000

Buildings 4,00,000 3,50,000 Liquidator’s Remuneration:

Machinery 1,60,000 2,00,000 `

Debtors 6,40,000 6,00,000 1½ on ` 16,62,000 24,930

Stock 4,00,000 4,61,000 2% on ` 10,000 200 25,130

Cash 51,000 51,000 Cost of Liquidation 2,000

Debentures 12,84,000

Unsecured Creditors 10,000

Return to Contributories:

7% Pref. Shareholders 3,00,000

Preference Dividend (arrears of 1½ year) 31,500

Equity Shareholders (6,000 shares

@ ` 1.263 approx. per share) 7,580

Equity Shareholders (3,000 shares

@ ` 0.263 approx. per share) 790

16,51,000 16,62,000 16,62,000

Working Note:

(1) Unsecured Creditors include B/P, Creditors and Preferential Creditors ` (2000 + 7000 +

1000 = 10,000)

×

10,000 2

(2) Liquidator’s commission on Unsecured Creditors = = 200

100

(3) As debenture-holders are being paid off on 31 May, 2010, they are entitled to get two

st

12,00,000 6 ×2

months’ extra interest i.e., April & May= × = 12,000

100 12

Amounted due to debenture-holders = ` 12,00,000 + 72,000 + 12,000 = 12,84,000.

(4) Amount left after the payment of Preference Shareholders’ Capital and their dividend.

` 16,62,000 – (1,000 + 25,130 + 2,000 + 12,84,000 + 10,000 + 3,00,000 + 31,500) = ` 8,370 From

this amount of ` 8,370, first of all 6000 equity shareholders will get ` 1 because they have

paid ` 1 more. That will be ` 6,000. Thus amount left ` 8,370 – ` 6,000 = ` 2,370. Now, this

amount of ` 2,370 will be divided in the ratio of 6000:3000 i.e., ` 1,580: ` 790.

lovely professional university 213