Page 220 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 220

Unit 10: Liquidation of Companies: Preparation of Accounts

Thus, 40,000 Equity shareholders will get 20,000 + 4,000 ` = 24,000 notes

24,000

Rate per Share = = ` 0.6

40,000

28,000 Equity shareholders will get ` 2,800

2,800

Rate of Dividend = = ` 0.1

28,000

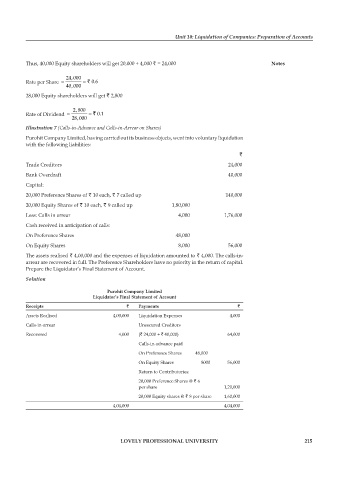

Illustration 7 (Calls-in-Advance and Calls-in-Arrear on Shares)

Purohit Company Limited, having carried out its business objects, went into voluntary liquidation

with the following liabilities:

`

Trade Creditors 24,000

Bank Overdraft 40,000

Capital:

20,000 Preference Shares of ` 10 each, ` 7 called up 140,000

20,000 Equity Shares of ` 10 each, ` 9 called up 1,80,000

Less: Calls in arrear 4,000 1,76,000

Cash received in anticipation of calls:

On Preference Shares 48,000

On Equity Shares 8,000 56,000

The assets realised ` 4,00,000 and the expenses of liquidation amounted to ` 4,000. The calls-in-

arrear are recovered in full. The Preference Shareholders have no priority in the return of capital.

Prepare the Liquidator’s Final Statement of Account.

Solution

purohit company limited

liquidator’s final statement of account

receipts ` payments `

Assets Realised 4,00,000 Liquidation Expenses 4,000

Calls-in-arrear Unsecured Creditors

Recovered 4,000 (` 24,000 + ` 40,000) 64,000

Calls-in-advance paid

On Preference Shares 48,000

On Equity Shares 8000 56,000

Return to Contributories:

20,000 Preference Shares @ ` 6

per share 1,20,000

20,000 Equity shares @ ` 8 per share 1,60,000

4,04,000 4,04,000

lovely professional university 215