Page 224 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 224

Unit 10: Liquidation of Companies: Preparation of Accounts

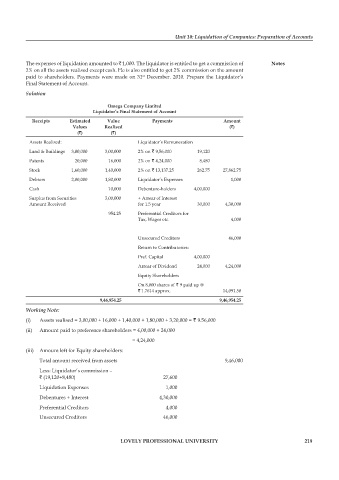

The expenses of liquidation amounted to ` 1,000. The liquidator is entitled to get a commission of notes

2% on all the assets realised except cash. He is also entitled to get 2% commission on the amount

paid to shareholders. Payments were made on 31 December. 2010. Prepare the Liquidator’s

st

Final Statement of Account.

Solution

omega company limited

liquidator’s final statement of account

receipts estimated value payments amount

values realised (`)

(`) (`)

Assets Realised: Liquidator’s Remuneration

Land & Buildings 3,00,000 3,00,000 2% on ` 9,56,000 19,120

Patents 20,000 16,000 2% on ` 4,24,000 8,480

Stock 1,60,000 1,40,000 2% on ` 13,137.25 262.75 27,862.75

Debtors 2,00,000 1,80,000 Liquidator’s Expenses 1,000

Cash 10,000 Debenture-holders 4,00,000

Surplus from Securities 3,00,000 + Arrear of Interest

Amount Received for 1.5 year 30,000 4,30,000

954.25 Preferential Creditors for

Tax, Wages etc. 4,000

Unsecured Creditors 46,000

Return to Contributories:

Pref. Capital 4,00,000

Arrear of Dividend 24,000 4,24,000

Equity Shareholders

On 8,000 shares of ` 9 paid up @

` 1.7614 approx. 14,091.50

9,46,954.25 9,46,954.25

Working Note:

(i) Assets realised = 3,00,000 + 16,000 + 1,40,000 + 1,80,000 + 3,20,000 = ` 9.56,000

(ii) Amount paid to preference shareholders = 4,00,000 + 24,000

= 4,24,000

(iii) Amount left for Equity shareholders:

Total amount received from assets 9,46,000

Less: Liquidator’s commission –

` (19,120+8,480) 27,600

Liquidation Expenses 1,000

Debentures + Interest 4,30,000

Preferential Creditors 4,000

Unsecured Creditors 46,000

lovely professional university 219