Page 226 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 226

Unit 10: Liquidation of Companies: Preparation of Accounts

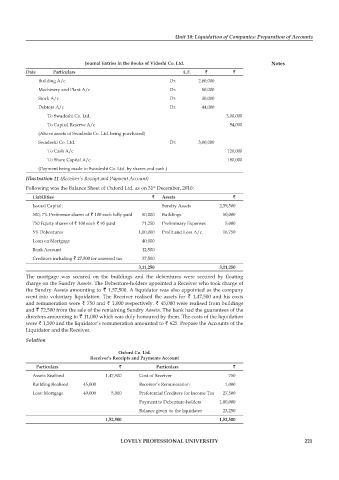

Journal entries in the Books of videshi co. ltd. notes

Date particulars l.f. ` `

Building A/c Dr. 2,00,000

Machinery and Plant A/c Dr. 80,000

Stock A/c Dr. 30,000

Debtors A/c Dr. 44,000

To Swadeshi Co. Ltd. 3,00,000

To Capital Reserve A/c 54,000

(Above assets of Swadeshi Co. Ltd. being purchased)

Swadeshi Co. Ltd. Dr. 3,00,000

To Cash A/c 120,000

To Share Capital A/c 180,000

(Payment being made to Swadeshi Co. Ltd. by shares and cash.)

Illustration 11 (Receiver’s Receipt and Payment Account)

Following was the Balance Sheet of Oxford Ltd. as on 31 December, 2010:

st

liabilities ` assets `

Issued Capital: Sundry Assets 2,39,500

500; 7% Preference shares of ` 100 each fully paid 50,000 Buildings 50,000

750 Equity shares of ` 100 each ` 95 paid 71,250 Preliminary Expenses 5,000

5% Debentures 1,00,000 Profit and Loss A/c. 16,750

Loan on Mortgage 40,000

Bank Account 12,500

Creditors including ` 27,500 for assessed tax 37,500

3,11,250 3,11,250

The mortgage was secured on the buildings and the debentures were secured by floating

charge on the Sundry Assets. The Debenture-holders appointed a Receiver who took charge of

the Sundry Assets amounting to ` 1,57,500. A liquidator was also appointed as the company

went into voluntary liquidation. The Receiver realised the assets for ` 1,47,500 and his costs

and remuneration were ` 750 and ` 1,000 respectively. ` 45,000 were realised from buildings

and ` 72,500 from the sale of the remaining Sundry Assets. The bank had the guarantees of the

directors amounting to ` 11,000 which was duly honoured by them. The costs of the liquidation

were ` 1,500 and the liquidator’s remuneration amounted to ` 625. Prepare the Accounts of the

Liquidator and the Receiver.

Solution

oxford co. ltd.

receiver’s receipts and payments account

particulars ` particulars `

Assets Realised 1,47,500 Cost of Receiver 750

Building Realised 45,000 Receiver’s Remuneration 1,000

Less: Mortgage 40,000 5,000 Preferential Creditors for Income Tax 27,500

Payment to Debenture-holders 1,00,000

Balance given to the liquidator 23,250

1,52,500 1,52,500

lovely professional university 221