Page 225 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 225

Accounting for Companies – II

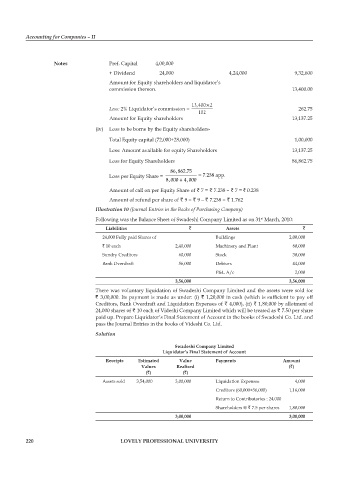

Notes Pref. Capital 4,00,000

+ Dividend 24,000 4,24,000 9,32,600

Amount for Equity shareholders and liquidator’s

commission thereon. 13,400.00

13,400 ×2

Less: 2% Liquidator’s commission = 262.75

102

Amount for Equity shareholders 13,137.25

(iv) Loss to be borne by the Equity shareholders-

Total Equity capital (72,000+28,000) 1,00,000

Less: Amount available for equity Shareholders 13,137.25

Loss for Equity Shareholders 86,862.75

86,862.75

Loss per Equity Share = = 7.238 app.

8,000 + 4,000

Amount of call on per Equity Share of ` 7 = ` 7.238 – ` 7 = ` 0.238

Amount of refund per share of ` 9 = ` 9 – ` 7.238 = ` 1.762

Illustration 10 (Journal Entries in the Books of Purchasing Company)

Following was the Balance Sheet of Swadeshi Company Limited as on 31 March, 2010:

st

Liabilities ` Assets `

24,000 Fully paid Shares of Buildings 2,00,000

` 10 each 2,40,000 Machinery and Plant 80,000

Sundry Creditors 60,000 Stock 30,000

Bank Overdraft 56,000 Debtors 44,000

P&L A/c 2,000

3,56,000 3,56,000

There was voluntary liquidation of Swadeshi Company Limited and the assets were sold for

` 3,00,000. Its payment is made as under: (i) ` 1,20,000 in cash (which is sufficient to pay off

Creditors, Bank Overdraft and Liquidation Expenses of ` 4,000), (ii) ` 1,80,000 by allotment of

24,000 shares of ` 10 each of Videshi Company Limited which will be treated as ` 7.50 per share

paid up. Prepare Liquidator’s Final Statement of Account in the books of Swadeshi Co. Ltd. and

pass the Journal Entries in the books of Videshi Co. Ltd.

Solution

Swadeshi Company Limited

Liquidator’s Final Statement of Account

Receipts Estimated Value Payments Amount

Values Realised (`)

(`) (`)

Assets sold 3,54,000 3,00,000 Liquidation Expenses 4,000

Creditors (60,000+56,000) 1,16,000

Return to Contributories : 24,000

Shareholders @ ` 7.5 per shares 1,80,000

3,00,000 3,00,000

220 LOVELY PROFESSIONAL UNIVERSITY