Page 228 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 228

Unit 10: Liquidation of Companies: Preparation of Accounts

l z In no case, such fixation of liabilities can exceed the statutory liability (towards unpaid notes

capital).

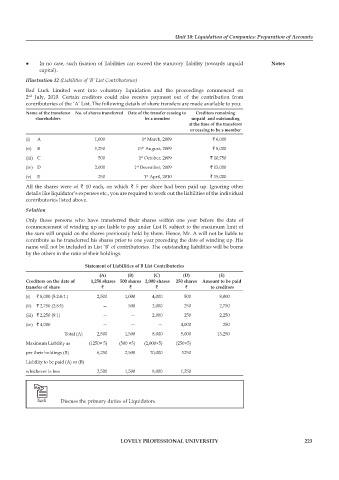

Illustration 12 (Liabilities of ‘B’ List Contributories)

Bad Luck Limited went into voluntary liquidation and the proceedings commenced on

2 July, 2010. Certain creditors could also receive payment out of the contribution from

nd

contributories of the ‘A’ List. The following details of share transfers are made available to you:

name of the transferor no. of shares transferred Date of the transfer ceasing to creditors remaining

shareholders be a member unpaid and outstanding

at the time of the transferor

or ceasing to be a member

st

(i) A 1,000 1 March, 2009 ` 6,000

(ii) B 1,250 15 August, 2009 ` 8,000

th

(iii) C 500 1 October, 2009 ` 10,750

st

(iv) D 2,000 1 December, 2009 ` 13,000

st

(v) E 250 1 April, 2010 ` 15,000

st

All the shares were of ` 10 each, on which ` 5 per share had been paid up. Ignoring other

details like liquidator’s expenses etc., you are required to work out the liabilities of the individual

contributories listed above.

Solution

Only those persons who have transferred their shares within one year before the date of

commencement of winding up are liable to pay under List B, subject to the maximum limit of

the sum still unpaid on the shares previously held by them. Hence, Mr. A will not be liable to

contribute as he transferred his shares prior to one year preceding the date of winding up. His

name will not be included in List ‘B’ of contributories. The outstanding liabilities will be borne

by the others in the ratio of their holdings.

statement of liabilities of B list contributories

(a) (B) (c) (D) (e)

creditors on the date of 1,250 shares 500 shares 2,000 shares 250 shares amount to be paid

transfer of share ` ` ` ` to creditors

(i) ` 8,000 (5:2:8:1.) 2,500 1,000 4,000 500 8,000

(ii) ` 2,750 (2:8:1) — 500 2,000 250 2,750

(iii) ` 2,250 (8:1) — — 2,000 250 2,250

(iv) ` 4,000 — — — 4,000 250

Total (A) 2,500 1,500 8,000 5,000 13,250

Maximum Liability as (1250× 5) (500 ×5) (2,000×5) (250×5)

per their holdings (B) 6,250 2,500 10,000 1250

Liability to be paid (A) or (B)

whichever is less 2,500 1,500 8,000 1,250

Task Discuss the primary duties of Liquidators.

lovely professional university 223