Page 233 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 233

Accounting for Companies – II

notes The assets realised the following sums:

Land & Buildings 40,000

Plant & Machinery 37,300

Fixture & Fittings 2,000

The liquidation expenses amounted to ` 2,000.

8. Temptation Limited went into voluntary liquidation on 31 December, 2010. The following

st

information is available with the liquidator:

Sundry Creditors amount to ` 1,51,320 of which ` 16,000 are preferential. 6% Debentures

carrying floating charge on the assets amounted to ` 1,60,000. Debenture-holders were

paid interest up to 30-6-2010.

The assets realised as follows:

Stock-in-Trade ` 1,68,000

Plant and Machinery ` 1,21,200

Cash-in-Hand stood at ` 1,000. Debentures were paid off on 30 June of the following

th

year with interest. Liquidator’s expenses amounted to ` 3,804 and they were entitled to

remuneration at 3% on the amount realised and 2% on the amount distributed to unsecured

creditors.

Prepare Liquidator’s Final Statement of Account.

9. Amod & Pramod Limited get into financial difficulties and on 31-3-2009 a Receiver was

appointed by the Debenture-holders under the terms of agreement which provided a

floating charge. A resolution of voluntary winding up was passed on April 30, 2009 when

a liquidator was appointed. The following is the summary of company’s position as on 31-

3-2009.

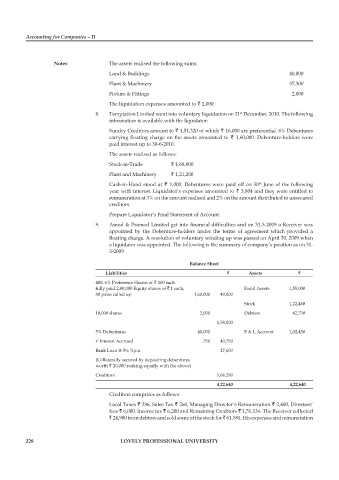

Balance sheet

liabilities ` assets `

400, 6% Preference Shares of ` 100 each

fully paid 2,00,000 Equity shares of ` 1 each, Fixed Assets 1,55,000

80 paise called up 1,60,000 40,000

Stock 1,22,460

10,000 shares 2,000 Debtors 42,730

1,58,000

5% Debentures 40,000 P & L Account 1,02,450

+ Interest Accrued 750 40,750

Bank Loan @ 5½ %p.a. 17,600

(Collaterally secured by depositing debentures

worth ` 20,000 ranking equally with the above)

Creditors 1,66,290

4,22,640 4,22,640

Creditors comprises as follows:

Local Taxes ` 296, Sales Tax ` 260, Managing Director’s Remuneration ` 2,400, Directors’

fees ` 6,000. Income tax ` 6,200 and Remaining Creditors ` 1,51,134. The Receiver collected

` 24,980 from debtors and sold some of the stock for ` 61,584. His expenses and remuneration

228 lovely professional university