Page 230 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 230

Unit 10: Liquidation of Companies: Preparation of Accounts

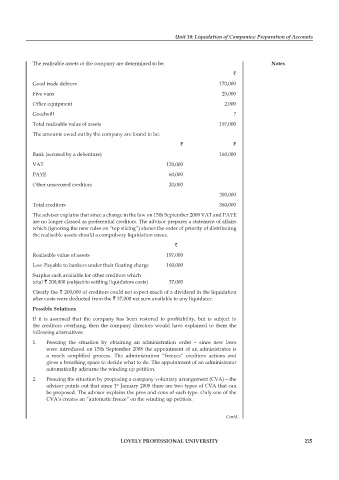

The realisable assets of the company are determined to be: notes

`

Good trade debtors 170,000

Five vans 25,000

Office equipment 2,000

Goodwill ?

Total realisable value of assets 197,000

The amounts owed out by the company are found to be:

` `

Bank (secured by a debenture) 160,000

VAT 120,000

PAYE 60,000

Other unsecured creditors 20,000

200,000

Total creditors 360,000

The adviser explains that since a change in the law on 15th September 2008 VAT and PAYE

are no longer classed as preferential creditors. The advisor prepares a statement of affairs

which (ignoring the new rules on “top slicing”) shows the order of priority of distributing

the realisable assets should a compulsory liquidation ensue.

`

Realisable value of assets 197,000

Less: Payable to bankers under their floating charge 160,000

Surplus cash available for other creditors which

total ` 200,000 (subject to settling liquidators costs) 37,000

Clearly the ` 200,000 of creditors could not expect much of a dividend in the liquidation

after costs were deducted from the ` 37,000 net sum available to any liquidator.

possible solutions

If it is assumed that the company has been restored to profitability, but is subject to

the creditors overhang, then the company directors would have explained to them the

following alternatives:

1. Freezing the situation by obtaining an administration order – since new laws

were introduced on 15th September 2008 the appointment of an administrator is

a much simplified process. The administration “freezes” creditors actions and

gives a breathing space to decide what to do. The appointment of an administrator

automatically adjourns the winding up petition.

2. Freezing the situation by proposing a company voluntary arrangement (CVA) – the

advisor points out that since 1 January 2008 there are two types of CVA that can

st

be proposed. The advisor explains the pros and cons of each type. Only one of the

CVA’s creates an “automatic freeze” on the winding up petition.

Contd...

lovely professional university 225