Page 223 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 223

Accounting for Companies – II

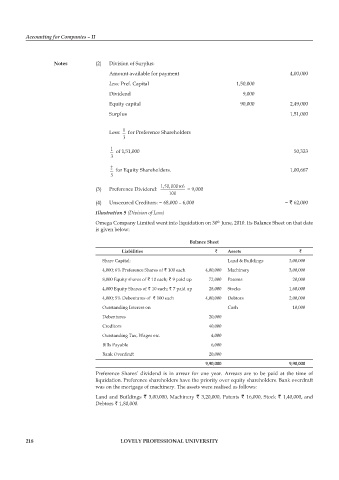

notes (2) Division of Surplus:

Amount available for payment 4,00,000

Less: Pref. Capital 1,50,000

Dividend 9,000

Equity capital 90,000 2,49,000

Surplus 1,51,000

1

Less: for Preference Shareholders

3

1 of 1,51,000 50,333

3

2 for Equity Shareholders. 1,00,667

3

(3) Preference Dividend: 1,50,000 ×6 = 9,000

100

(4) Unsecured Creditors: = 68,000 – 6,000 = ` 62,000

Illustration 9 (Division of Loss)

Omega Company Limited went into liquidation on 30 June, 2010. Its Balance Sheet on that date

th

is given below:

Balance sheet

liabilities ` assets `

Share Capital: Land & Buildings 3,00,000

4,000; 6% Preference Shares of ` 100 each 4,00,000 Machinery 3,00,000

8,000 Equity shares of ` 10 each; ` 9 paid up 72,000 Patents 20,000

4,000 Equity Shares of ` 10 each; ` 7 paid up 28,000 Stocks 1,60,000

4,000; 5% Debentures of ` 100 each 4,00,000 Debtors 2,00,000

Outstanding Interest on Cash 10,000

Debentures 20,000

Creditors 40,000

Outstanding Tax, Wages etc. 4,000

Bills Payable 6,000

Bank Overdraft 20,000

9,90,000 9,90,000

Preference Shares’ dividend is in arrear for one year. Arrears are to be paid at the time of

liquidation. Preference shareholders have the priority over equity shareholders. Bank overdraft

was on the mortgage of machinery. The assets were realised as follows:

Land and Buildings ` 3,00,000, Machinery ` 3,20,000, Patents ` 16,000, Stock ` 1,40,000, and

Debtors ` 1,80,000.

218 lovely professional university